Costco 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

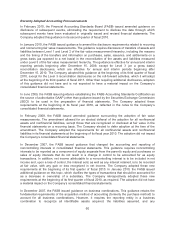

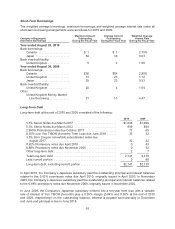

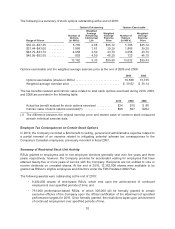

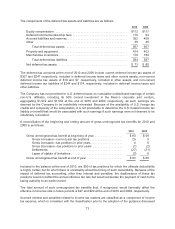

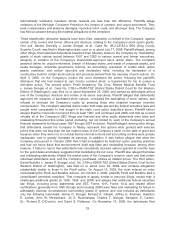

The following is a summary of stock options outstanding at the end of 2010:

Options Outstanding Options Exercisable

Range of Prices

Number of

Options

(in 000’s)

Weighted

Average

Remaining

Contractual

Life

Weighted

Average

Exercise

Price

Number of

Options

(in 000’s)

Weighted-

Average

Exercise

Price

$30.41–$37.35 ........... 5,785 2.68 $35.12 5,785 $35.12

$37.44–$43.00 ........... 1,866 1.61 39.29 1,866 39.29

$43.79–$43.79 ........... 4,658 4.59 43.79 4,658 43.79

$45.99–$52.50 ........... 853 4.59 46.20 723 46.15

13,162 3.33 $39.50 13,032 $39.43

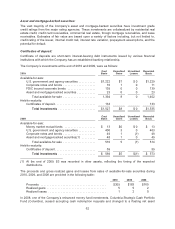

Options exercisable and the weighted average exercise price at the end of 2009 and 2008:

2009 2008

Options exercisable (shares in 000’s) ............................ 16,588 15,735

Weighted average exercise price ............................... $ 39.62 $ 39.14

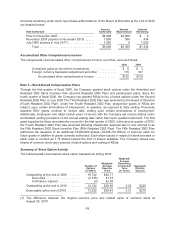

The tax benefits realized and intrinsic value related to total stock options exercised during 2010, 2009,

and 2008 are provided in the following table:

2010 2009 2008

Actual tax benefit realized for stock options exercised ......... $34 $10 $ 86

Intrinsic value of stock options exercised(1) ................. $98 $27 $262

(1) The difference between the original exercise price and market value of common stock measured

at each individual exercise date.

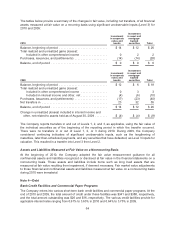

Employee Tax Consequences on Certain Stock Options

In 2010, the Company recorded a $24 benefit to selling, general and administrative expense related to

a partial reversal of an expense related to mitigating potential adverse tax consequences to the

Company’s Canadian employees, previously recorded in fiscal 2007.

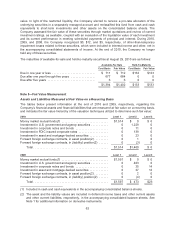

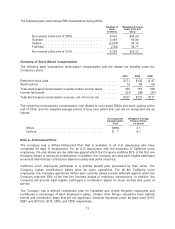

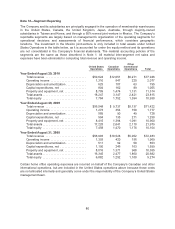

Summary of Restricted Stock Unit Activity

RSUs granted to employees and to non-employee directors generally vest over five years and three

years, respectively; however, the Company provides for accelerated vesting for employees that have

attained twenty-five or more years of service with the Company. Recipients are not entitled to vote or

receive dividends on unvested shares. At the end of 2010, 12,362,000 shares were available to be

granted as RSUs to eligible employees and directors under the Fifth Restated 2002 Plan.

The following awards were outstanding at the end of 2010:

• 8,492,000 shares of time-based RSUs, which vest upon the achievement of continued

employment over specified periods of time; and

• 761,000 performance-based RSUs, of which 305,000 will be formally granted to certain

executive officers of the Company upon the official certification of the attainment of specified

performance targets for 2010. Once formally granted, the restrictions lapse upon achievement

of continued employment over specified periods of time.

70