Costco 2010 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our sales results continue to be negatively impacted by general economic conditions, and those

conditions may continue to have a significant adverse impact on spending by our members. We

believe, however, that due to the nature of our business model, we are better positioned than many

retailers to compete in such an environment.

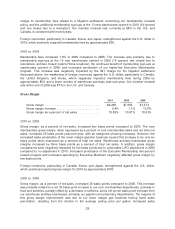

Comparable Sales

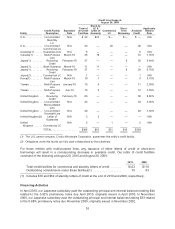

Comparable sales increased 7% in 2010 and were positively impacted primarily by an increase in

shopping frequency. Strengthening foreign currencies positively impacted comparable sales by

approximately $1,510 (217 basis points) in 2010. Gasoline price inflation positively impacted

comparable sales results by approximately $882 (126 basis points) during 2010. Reported comparable

sales growth includes the negative impact of cannibalization (established warehouses losing sales to

our newly opened locations).

2009 vs. 2008

Net Sales

Our 2009 sales results, particularly in hardlines and softlines, were negatively impacted by general

economic conditions. Net sales decreased 1.5% during 2009 compared to 2008. The $1,088 decrease

was comprised of a $2,590 decrease in comparable sales, partially offset by an increase of $1,502

primarily from sales at new warehouses opened during 2009 and 2008. Our sales were also impacted

by a lower number of warehouse openings year-over-year.

Foreign currencies, particularly in Canada, the United Kingdom, and Korea, weakened against the U.S.

dollar, which negatively impacted net sales during 2009 by approximately $2,421 (341 basis points).

Net sales were also negatively impacted by gasoline price deflation during 2009 by approximately

$2,164 (305 basis points), which resulted from a 30% decline in the average sales price per gallon.

Comparable Sales

Comparable sales decreased 4% in 2009. Weakening foreign currencies negatively impacted

comparable sales by approximately $2,339 (333 basis points) in 2009. Gasoline price deflation

negatively impacted comparable sales results by approximately $2,113 (298 basis points) during 2009.

Comparable sales were negatively impacted by a decline in the average amount spent (after

adjustment for gasoline price deflation and measured in local currencies), partially offset by an

increase in shopping frequency. Reported comparable sales growth includes the negative impact of

cannibalization.

Membership Fees

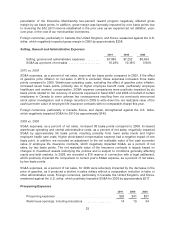

2010 2009 2008

Membership fees ............................. $ 1,691 $ 1,533 $ 1,506

Membership fees increase ..................... 10.3% 1.8% 14.7%

Membership fees as a percent of net sales ........ 2.22% 2.19% 2.12%

Total cardholders (000’s) ....................... 58,000 56,000 53,500

2010 vs. 2009

Membership fees increased 10.3% in 2010 compared to 2009. Membership fees in 2010 were

positively impacted due to the increased penetration of our higher-fee Executive Membership program,

the continued benefit of membership sign-ups at warehouses opened in 2009 and 2008, a 2009 $27

27