Costco 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

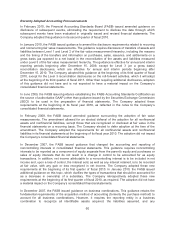

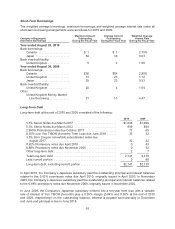

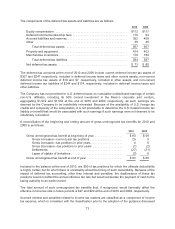

Maturities of long-term debt during the next five fiscal years and thereafter are as follows:

2011 ........................................................ $ 0

2012 ........................................................ 899

2013 ........................................................ 0

2014 ........................................................ 0

2015 ........................................................ 0

Thereafter ................................................... 1,242

Total .................................................... $2,141

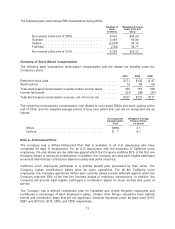

Note 5—Leases

Operating Leases

The Company leases land and/or buildings at warehouses and certain other office and distribution

facilities primarily under operating leases. These leases expire at various dates through 2049, with the

exception of one lease in the Company’s United Kingdom subsidiary, which expires in 2151. These

leases generally contain one or more of the following options which the Company can exercise at the

end of the initial lease term: (a) renewal of the lease for a defined number of years at the then-fair

market rental rate or rate stipulated in the lease agreement; (b) purchase of the property at the then-

fair market value; or (c) right of first refusal in the event of a third party purchase offer.

The Company accounts for its lease expense with free rent periods and step-rent provisions on a

straight-line basis over the original term of the lease, from the date the Company has control of the

property. Certain leases provide for periodic rental increases based on the price indices, and some of

the leases provide for rents based on the greater of minimum guaranteed amounts or sales volume.

Contingent rents have not been material.

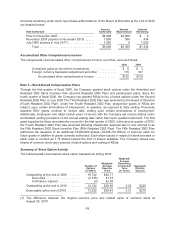

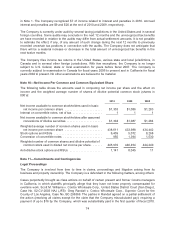

The aggregate rental expense and sublease income, related to certain of its operating lease

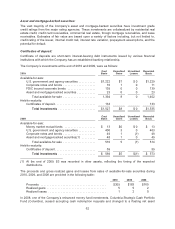

arrangements, for 2010, 2009 and 2008 are as follows:

Aggregate

rental

expense

Sublease

income(1)

2010 .............................................. $187 $10

2009 .............................................. 177 10

2008 .............................................. 167 10

(1) Included in interest income and other

Capital Leases

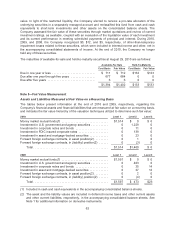

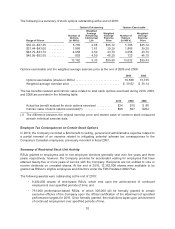

The Company has entered into four capital leases for warehouse locations. Capital lease liabilities

were recorded at the lesser of the estimated fair market value of the leased property or the net present

value of the aggregate future minimum lease payments. These leases expire at various dates through

2040.

Gross assets recorded under these leases were $169 and $77, at the end of 2010 and 2009,

respectively. These assets, net of accumulated amortization of $7 and $1 at the end of 2010 and 2009,

respectively, are included in buildings and improvements in the accompanying consolidated balance

sheets. Amortization expense on capital lease assets is recorded as depreciation expense and is

included in selling, general and administrative expenses.

67