Costco 2010 Annual Report Download - page 61

Download and view the complete annual report

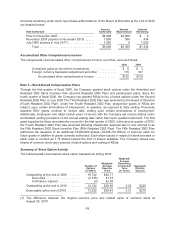

Please find page 61 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other-Than-Temporary Impairment

The Company periodically evaluates unrealized losses in its investment securities for other-than-

temporary impairment using both qualitative and quantitative criteria. In the event a security is deemed

to be other-than-temporarily impaired, the Company recognizes the credit loss component in interest

income and other, net in the consolidated financial statements. The Company generally only invests in

debt securities.

Income Taxes

Effective September 3, 2007, the Company adopted authoritative guidance related to uncertain tax

positions, which clarified the accounting for uncertainty in income taxes recognized in financial

statements. This guidance prescribes a recognition threshold and measurement attribute for the

financial statement recognition and measurement of a tax position taken or expected to be taken in a

tax return and also provides guidance on derecognition, classification, interest and penalties,

accounting in interim periods, disclosure, and transition. The cumulative impact of the initial adoption of

this guidance was to decrease the beginning balance of retained earnings and to increase the

Company’s liability for uncertain tax positions and related interest by a corresponding amount.

The Company accounts for income taxes using the asset and liability method. Under the asset and

liability method, deferred tax assets and liabilities are recognized for the future tax consequences

attributed to differences between the financial statement carrying amounts of existing assets and

liabilities and their respective tax bases and tax credits and loss carry-forwards. Deferred tax assets

and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in

which those temporary differences and carry-forwards are expected to be recovered or settled. The

effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the

period that includes the enactment date. A valuation allowance is established when necessary to

reduce deferred tax assets to amounts expected to be realized.

The determination of the Company’s provision for income taxes requires significant judgment, the use

of estimates, and the interpretation and application of complex tax laws. Significant judgment is

required in assessing the timing and amounts of deductible and taxable items and the probability of

sustaining uncertain tax positions. The benefits of uncertain tax positions are recorded in the

Company’s consolidated financial statements only after determining a more-likely-than-not probability

that the uncertain tax positions will withstand challenge, if any, from tax authorities. When facts and

circumstances change, the Company reassess these probabilities and records any changes in the

consolidated financial statements as appropriate. See Note 9 for additional information.

Net Income Attributable to Costco (Net Income) per Common Share

The computation of basic net income per share uses the weighted average number of shares that were

outstanding during the period. The computation of diluted net income per share uses the weighted

average number of shares in the basic net income per share calculation plus the number of common

shares that would be issued assuming exercise and vesting of all potentially dilutive common shares

outstanding using the treasury stock method for shares subject to stock options and restricted stock

units and the “if converted” method for the convertible note securities.

Stock Repurchase Programs

Shares repurchased are retired, in accordance with the Washington Business Corporation Act. The par

value of repurchased shares is deducted from common stock and the excess repurchase price over

par value is deducted from additional paid-in capital and retained earnings. See Note 6 for additional

information.

59