Costco 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

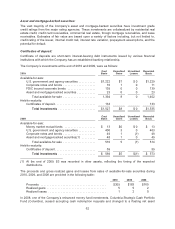

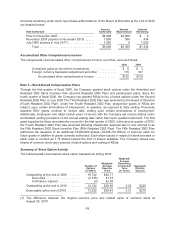

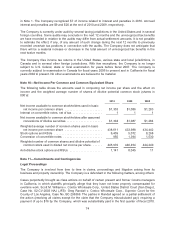

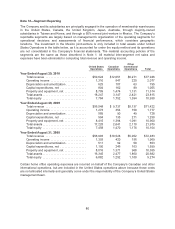

The following table summarizes RSU transactions during 2010:

Number of

Units

(in 000’s)

Weighted-Average

Grant Date Fair

Value

Non-vested at the end of 2009 ................... 8,531 $54.60

Granted ..................................... 3,419 55.94

Vested ...................................... (2,597) 54.15

Forfeited ..................................... (100) 54.71

Non-vested at the end of 2010 ................... 9,253 $55.22

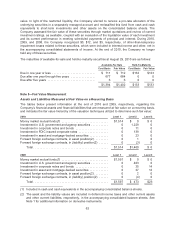

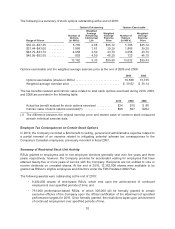

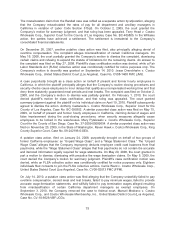

Summary of Stock-Based Compensation

The following table summarizes stock-based compensation and the related tax benefits under the

Company’s plans:

2010 2009 2008

Restricted stock units ............................................ $171 $132 $ 97

Stock options .................................................. 19 49 69

Total stock-based compensation expense before income taxes ......... 190 181 166

Income tax benefit .............................................. (63) (60) (55)

Total stock-based compensation expense, net of income tax ........... $127 $121 $111

The remaining unrecognized compensation cost related to non-vested RSUs and stock options at the

end of 2010, and the weighed-average period of time over which this cost will be recognized are as

follows:

Unrecognized

Compensation

Cost

Weighted Average

Period of Time

(in years)

RSUs ........................................... $359 3.1

Options .......................................... $ 1 0.1

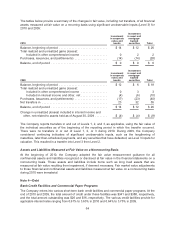

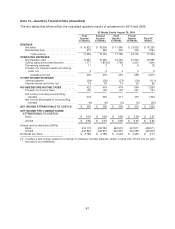

Note 8—Retirement Plans

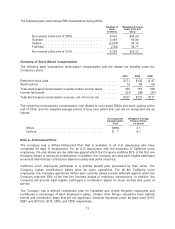

The Company has a 401(k) Retirement Plan that is available to all U.S. employees who have

completed 90 days of employment. For all U.S. employees, with the exception of California union

employees, the plan allows pre-tax deferrals against which the Company matches 50% of the first one

thousand dollars of employee contributions. In addition, the Company provides each eligible participant

an annual discretionary contribution based on salary and years of service.

California union employees participate in a defined benefit plan sponsored by their union. The

Company makes contributions based upon its union agreement. For all the California union

employees, the Company-sponsored 401(k) plan currently allows pre-tax deferrals against which the

Company matches 50% of the first five hundred dollars of employee contributions. In addition, the

Company will provide each eligible participant a contribution based on hours worked and years of

service.

The Company has a defined contribution plan for Canadian and United Kingdom employees and

contributes a percentage of each employee’s salary. Certain other foreign operations have defined

benefit and contribution plans that are not significant. Amounts expensed under all plans were $313,

$287, and $272 for 2010, 2009, and 2008, respectively.

71