Costco 2010 Annual Report Download - page 63

Download and view the complete annual report

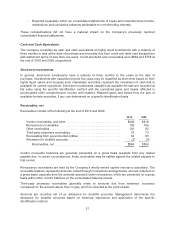

Please find page 63 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.noncontrolling interest in the acquiree. It establishes the acquisition-date fair value as the

measurement objective, and requires the capitalization of in-process research and development at fair

value and the expensing of acquisition-related costs as incurred. The Company is subject to these

requirements as of the beginning of its fiscal year 2010 in the event of a business combination.

Recent Accounting Pronouncements Not Yet Adopted

In October 2009, the FASB issued amended guidance on revenue recognition for multiple-deliverable

revenue arrangements. Under this guidance, when vendor-specific objective evidence or third-party

evidence for deliverables in an arrangement cannot be determined, a best estimate of the selling price

is required to separate deliverables and allocate arrangement consideration using the relative selling-

price method. This guidance also prescribes new disclosure requirements on how the application of the

relative selling price method affects the timing and amount of revenue recognition. The guidance is

effective for revenue arrangements entered into for fiscal years beginning on or after June 15, 2010.

The Company will adopt this guidance at the beginning of its fiscal year 2011. The Company does not

expect the adoption of this standard to have a material impact on its consolidated financial statements.

In June 2009, the FASB issued amended guidance concerning whether variable interests constitute

controlling financial interests. This guidance is effective for the first annual reporting period that begins

after November 15, 2009. The Company will adopt this guidance at the beginning of its fiscal year

2011. As a result of the adoption, the Company will begin consolidating its 50%-owned joint venture,

Costco Mexico on a prospective basis. Costco Mexico operates 32 warehouses similar in format and

merchandise offerings to Costco warehouses operated world-wide. Historically, the Company

accounted for its interest in Costco Mexico under the equity method. Consolidation of Costco Mexico is

expected to increase total assets, liabilities, and revenue by approximately 3%, with no impact on net

income attributable to Costco.

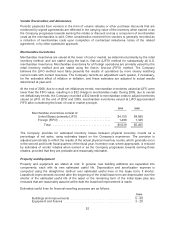

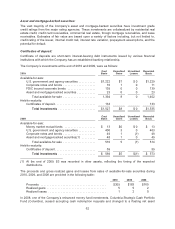

Note 2—Investments

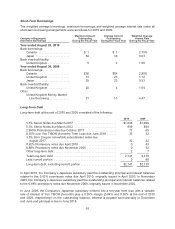

The major classes of the Company’s investments are as follows:

Money market mutual funds:

The Company invests in money funds that seek to maintain a net asset value of par, while limiting

overall exposure to credit, market, and liquidity risks.

U.S. government and agency securities:

These U.S. government-secured debt instruments are publically traded and valued. Losses in this

category are primarily due to market liquidity and interest rate reductions.

Corporate notes and bonds:

The Company evaluates its corporate debt securities based on a variety of factors including, but not

limited to, the credit rating of the issuer. The vast majority of the Company’s corporate debt securities

are rated investment grade by the major rating agencies.

FDIC insured corporate bonds:

These bonds are guaranteed by the full faith and credit of the U.S. government under the FDIC’s

Temporary Liquidity Guarantee Program. Losses in this category are primarily due to market liquidity

and interest rate reductions.

61