Costco 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

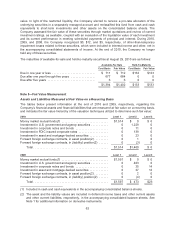

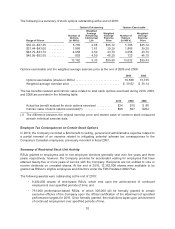

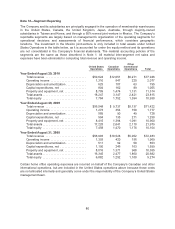

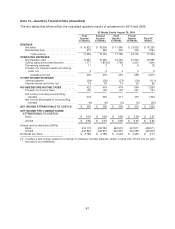

The components of the deferred tax assets and liabilities are as follows:

2010 2009

Equity compensation .............................................. $112 $117

Deferred income/membership fees ................................... 118 94

Accrued liabilities and reserves ...................................... 392 408

Other ........................................................... 35 48

Total deferred tax assets ....................................... 657 667

Property and equipment ............................................ 414 403

Merchandise inventories ............................................ 170 184

Total deferred tax liabilities ...................................... 584 587

Net deferred tax assets ............................................ $ 73 $ 80

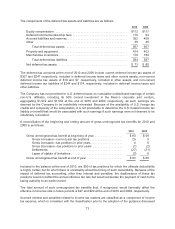

The deferred tax accounts at the end of 2010 and 2009 include current deferred income tax assets of

$307 and $247 respectively, included in deferred income taxes and other current assets; non-current

deferred income tax assets of $10 and $7, respectively, included in other assets; and non-current

deferred income tax liabilities of $244 and $174, respectively, included in deferred income taxes and

other liabilities.

The Company has not provided for U.S. deferred taxes on cumulative undistributed earnings of certain

non-U.S. affiliates, including its 50% owned investment in the Mexico corporate joint venture,

aggregating $1,972 and $1,554 at the end of 2010 and 2009, respectively, as such earnings are

deemed by the Company to be indefinitely reinvested. Because of the availability of U.S. foreign tax

credits and complexity of the computation, it is not practicable to determine the U.S. federal income tax

liability or benefit that would be associated with such earnings if such earnings were not deemed to be

indefinitely reinvested.

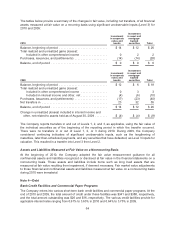

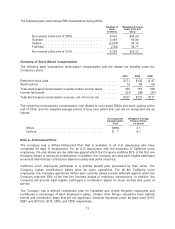

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits for 2010 and

2009 is as follows:

2010 2009

Gross unrecognized tax benefit at beginning of year .................. $80 $98

Gross increases—current year tax positions ..................... 29 9

Gross increases—tax positions in prior years .................... 4 6

Gross decreases—tax positions in prior years ................... (1) (2)

Settlements ............................................... (27) (31)

Lapse of statute of limitations ................................. (2) 0

Gross unrecognized tax benefit at end of year ....................... $83 $80

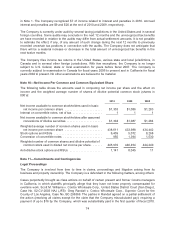

Included in the balance at the end of 2010, are $50 of tax positions for which the ultimate deductibility

is highly certain but for which there is uncertainty about the timing of such deductibility. Because of the

impact of deferred tax accounting, other than interest and penalties, the disallowance of these tax

positions would not affect the annual effective tax rate but would accelerate the payment of cash to the

taxing authority to an earlier period.

The total amount of such unrecognized tax benefits that, if recognized, would favorably affect the

effective income tax rate in future periods is $27 and $20 at the end of 2010 and 2009, respectively.

Accrued interest and penalties related to income tax matters are classified as a component of income

tax expense, which is consistent with the classification prior to the adoption of the guidance discussed

73