Costco 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

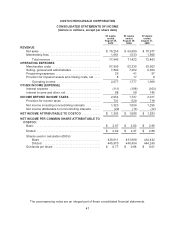

COSTCO WHOLESALE CORPORATION

CONSOLIDATED STATEMENTS OF EQUITY

AND COMPREHENSIVE INCOME

(dollars in millions)

Common Stock Additional

Paid-in

Capital

Accumulated

Other

Comprehensive

Income

Retained

Earnings

Total Costco

Stockholders’

Equity

Non-

controlling

Interests

Total

Equity

Shares

(000’s) Amount

BALANCE AT SEPTEMBER 2, 2007 . . 437,013 $2 $3,118 $ 374 $5,132 $ 8,626 $ 67 $ 8,693

Cumulative effect of adoption of

guidance related to uncertain tax

positions ........................ (6) (6) (6)

Adjusted balance at September 2,

2007 ........................... 437,013 2 3,118 374 5,126 8,620 67 8,687

Comprehensive Income:

Net income .................... 1,283 1,283 12 1,295

Foreign currency translation

adjustment and other .......... (90) (90) 1 (89)

Tax benefit on translation gain in

relation to earnings subject to

repatriation .................. 4 4 0 4

Comprehensive income .......... 1,197 13 1,210

Stock options exercised and vesting of

restricted stock units, including

income tax benefits and other ...... 9,299 0 363 363 363

Conversion of convertible notes ....... 13 0 0 0

Repurchase of common stock ........ (13,812) 0 (104) (783) (887) (887)

Stock-based compensation .......... 166 166 166

Cash dividends .................... (265) (265) 0 (265)

BALANCE AT AUGUST 31, 2008 ..... 432,513 2 3,543 288 5,361 9,194 80 9,274

Comprehensive Income:

Net income .................... 1,086 1,086 13 1,099

Unrealized gain on short-term

investments, net of ($2) tax ..... 3 3 0 3

Foreign currency translation

adjustment and other .......... (181) (181) (4) (185)

Comprehensive income .......... 908 9 917

Stock options exercised and vesting of

restricted stock units, including

income tax benefits and other ...... 3,794 0 75 75 75

Conversion of convertible notes ....... 562 0 19 19 19

Repurchase of common stock ........ (895) 0 (7) (50) (57) (57)

Stock-based compensation .......... 181 181 181

Cash dividends .................... (296) (296) (296)

Distribution to noncontrolling interest . . . (9) (9)

BALANCE AT AUGUST 30, 2009 ..... 435,974 2 3,811 110 6,101 10,024 80 10,104

Comprehensive Income:

Net income .................... 1,303 1,303 20 1,323

Unrealized gain on short-term

investments, net of ($1) tax ..... 3 3 0 3

Foreign currency translation

adjustment and other .......... 9 9 1 10

Comprehensive income .......... 1,315 21 1,336

Stock options exercised and vesting of

restricted stock units, including

income tax benefits and other ...... 7,461 0 205 205 205

Conversion of convertible notes ....... 18 0 1 1 1

Repurchase of common stock ........ (9,943) 0 (92) (476) (568) (568)

Stock-based compensation .......... 190 190 190

Cash dividends .................... (338) (338) (338)

BALANCE AT AUGUST 29, 2010 ..... 433,510 $2 $4,115 $ 122 $6,590 $10,829 $101 $10,930

The accompanying notes are an integral part of these consolidated financial statements.

48