Costco 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

penetration of the Executive Membership two-percent reward program negatively affected gross

margin by six basis points. In addition, gross margin was favorably impacted by nine basis points due

to reversing the $32 LIFO reserve established in the prior year as we experienced net deflation, year-

over-year, in the cost of our merchandise inventories.

Foreign currencies, particularly in Canada, the United Kingdom, and Korea, weakened against the U.S.

dollar, which negatively impacted gross margin in 2009 by approximately $258.

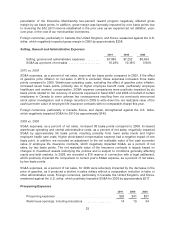

Selling, General and Administrative Expenses

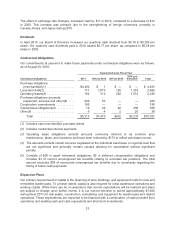

2010 2009 2008

Selling, general and administrative expenses ......... $7,840 $7,252 $6,954

SG&A as a percent of net sales .................... 10.28% 10.38% 9.80%

2010 vs. 2009

SG&A expenses, as a percent of net sales, improved ten basis points compared to 2009. If the effect

of gasoline price inflation on net sales in 2010 is excluded, these expenses increased three basis

points compared to 2009. Warehouse operating costs, excluding the effect of gasoline price inflation,

increased seven basis points, primarily due to higher employee benefit costs, particularly employee

healthcare and workers’ compensation. SG&A expense comparisons were positively impacted by six

basis points related to: the recovery of amounts expensed in fiscal 2007 and 2008 on behalf of certain

employees in Canada to cover adverse tax consequences resulting from our previously announced

stock option investigation; and a charge recorded in 2009 to write down the net realizable value of the

cash surrender value of employee life insurance contracts with no comparable charge this year.

Foreign currencies, particularly in Canada, Korea, and Japan, strengthened against the U.S. dollar,

which negatively impacted SG&A for 2010 by approximately $140.

2009 vs. 2008

SG&A expenses, as a percent of net sales, increased 58 basis points compared to 2008. Increased

warehouse operating and central administrative costs, as a percent of net sales, negatively impacted

SG&A by approximately 56 basis points, resulting primarily from lower sales levels and higher

employee health care costs. Higher stock-based compensation expense had a negative impact of one

basis point. In addition, we recorded an adjustment to the net realizable value of the cash surrender

value of employee life insurance contracts, which negatively impacted SG&A, as a percent of net

sales, by two basis points. The net realizable value of the insurance contracts is largely based on

changes in investment assets underlying the policies and is subject to conditions generally affecting

equity and debt markets. In 2008, we recorded a $16 reserve in connection with a legal settlement,

which positively impacted the comparison to current year’s SG&A expense, as a percent of net sales,

by two basis points.

SG&A expenses, as a percent of net sales, for 2009 were adversely impacted by the decrease in the

price of gasoline, as it produced a decline in sales dollars without a comparative reduction in labor or

other administrative costs. Foreign currencies, particularly in Canada, the United Kingdom, and Korea,

weakened against the U.S. dollar, which positively impacted SG&A for 2009 by approximately $217.

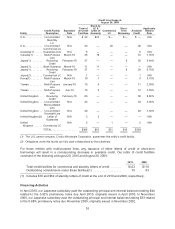

Preopening Expenses

2010 2009 2008

Preopening expenses .................................... $26 $41 $57

Warehouse openings, including relocations .................. 14 19 34

29