Boeing 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.80

work include Airborne Early Warning and Control, Commercial Crew, India P-8I, Saudi F-15, USAF KC-46A

Tanker and commercial and military satellites. The operational and technical complexities of these contracts

create financial risk, which could trigger termination provisions, order cancellations or other financially

significant exposure. Changes to cost and revenue estimates could result in lower margins or material

charges for reach-forward losses. For example, during the second quarter of 2014, higher estimated costs

to complete the KC-46A Tanker contract for the U.S. Air Force resulted in a reach-forward loss of $425 of

which the Commercial Airplanes segment recorded $238 and the BMA segment recorded $187.

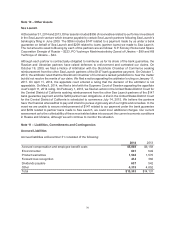

Recoverable Costs on Government Contracts

Our final incurred costs for each year are subject to audit and review for allowability by the U.S. government,

which can result in payment demands related to costs they believe should be disallowed. We work with

the U.S. government to assess the merits of claims and where appropriate reserve for amounts disputed.

If we are unable to satisfactorily resolve disputed costs, we could be required to record an earnings charge

and/or provide refunds to the U.S. government.

Russia/Ukraine

We continue to monitor political unrest involving Russia and Ukraine, where we and some of our suppliers

source titanium products and/or have operations. A number of our commercial customers also have

operations in Russia and Ukraine. To date, we have not experienced any significant disruptions to

production or deliveries. Should suppliers or customers experience disruption, our production and/or

deliveries could be materially impacted.

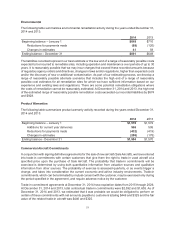

747 and 787 Commercial Airplane Programs

The development and initial production of new commercial airplanes and new commercial airplane

derivatives, which include the 747 and 787, entail significant commitments to customers and suppliers as

well as substantial investments in working capital, infrastructure and research and development. The 747

and 787 programs had gross margins that were breakeven or near breakeven during 2014.

Lower-than-expected demand for large commercial passenger and freighter aircraft have resulted in

ongoing pricing pressures and fewer 747 orders than anticipated. We continue to have a number of unsold

747 production positions. If market, production and other risks cannot be mitigated, the program could

face a reach-forward loss that may be material.

The combination of production challenges, change incorporation, schedule delays and customer and

supplier impacts has created significant pressure on 787 program profitability. If risks related to this program,

including risks associated with planned production rate increases or introducing and manufacturing the

787-10 derivative as scheduled cannot be mitigated, the program could face additional customer claims

and/or supplier assertions, as well as a reach-forward loss that may be material.