Boeing 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

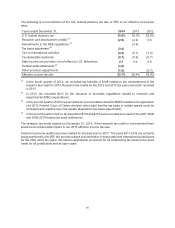

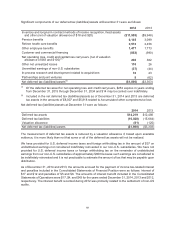

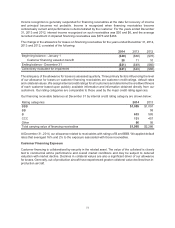

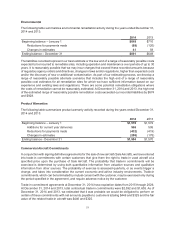

The following is a reconciliation of the U.S. federal statutory tax rate of 35% to our effective income tax

rates:

Years ended December 31, 2014 2013 2012

U.S. federal statutory tax 35.0% 35.0% 35.0%

Research and development credits (1) (2.9) (4.9) 0.8

Amendments to the R&E regulations (2) (3.4)

Tax basis adjustment (3) (3.6)

Tax on international activities (0.2) (0.1) (1.2)

Tax deductible dividends (0.7) (0.6) (0.7)

State income tax provision, net of effect on U.S. federal tax 0.7 0.4 0.8

Federal audit settlements (4) (3.6)

Other provision adjustments (1.0) (0.7)

Effective income tax rate 23.7% 26.4% 34.0%

(1) In the fourth quarter of 2014, we recorded tax benefits of $188 related to the reinstatement of the

research tax credit for 2014. Research tax credits for the 2013 and 2012 tax years were both recorded

in 2013.

(2) In 2013, we recorded $212 for the issuance of favorable regulations related to research and

experimental (R&E) expenditures.

(3) In the second quarter of 2014 we recorded an incremental tax benefit of $265 related to the application

of a 2012 Federal Court of Claims decision which held that the tax basis in certain assets could be

increased and realized upon the assets' disposition (tax basis adjustment).

(4) In the second quarter of 2014, tax benefits of $116 and $143 were recorded as a result of the 2007-2008

and 2009-2010 federal tax audit settlements.

The research tax credit expired on December 31, 2014. If the research tax credit is not extended there

would be an unfavorable impact to our 2015 effective income tax rate.

Federal income tax audits have been settled for all years prior to 2011. The years 2011-2012 are currently

being examined by the IRS. We are also subject to examination in major state and international jurisdictions

for the 2001-2014 tax years. We believe appropriate provisions for all outstanding tax issues have been

made for all jurisdictions and all open years.