Boeing 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

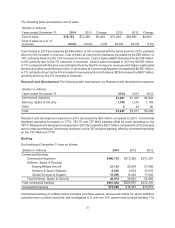

compensation expense. The A-12 aircraft litigation settlement resulted in the Company recording a $406

million pre-tax charge in 2013, which consisted of writing-off A-12 inventory, recorded as cost of sales,

and providing three EA-18G Growlers at no cost to the U.S. Navy, recorded as a reduction in revenues.

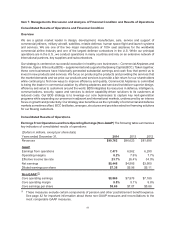

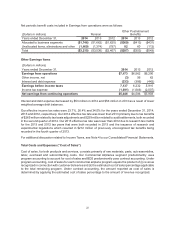

Core operating earnings in 2014 increased by $984 million compared with 2013 primarily reflecting higher

earnings at Commercial Airplanes and the 2013 A-12 charge. Core operating earnings in 2013 increased

by $687 million compared with 2012 as higher earnings at Commercial Airplanes and BDS more than

offset the A-12 charge and higher 2013 deferred compensation expense.

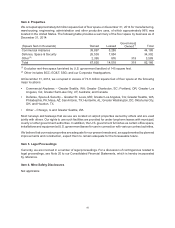

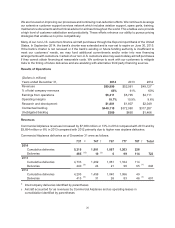

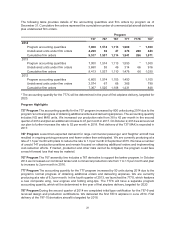

Unallocated Items, Eliminations and Other The most significant items included in Unallocated items,

eliminations and other are shown in the following table:

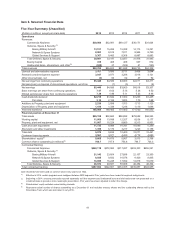

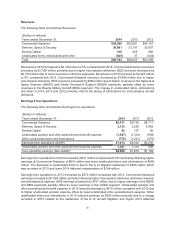

(Dollars in millions)

Years ended December 31, 2014 2013 2012

Share-based plans ($67) ($95) ($81)

Deferred compensation (44) (238) (75)

Eliminations and other (665) (522) (643)

Litigation settlements (406) 121

Sub-total (included in core operating earnings*) (776) (1,261) (678)

Pension (1,469) (1,374) (787)

Postretirement 82 60 (112)

Pension and other postretirement benefit expense

(excluded from core operating earnings*) (1,387) (1,314) (899)

Total unallocated items, eliminations and other ($2,163) ($2,575) ($1,577)

* Core operating earnings is a Non-GAAP measure that excludes certain components of pension and other

postretirement benefit expense. See page 42.

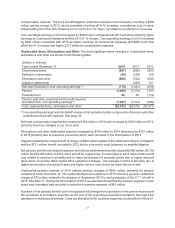

Deferred compensation expense decreased by $194 million in 2014 and increased by $163 million in 2013,

primarily driven by changes in our stock price.

Eliminations and other unallocated expense increased by $143 million in 2014 decreased by $121 million

in 2013 primarily due to insurance recoveries which were recorded in the third quarter of 2013.

Litigation settlements include the 2013 charge of $406 million related to the settlement of the A-12 litigation

and the $121 million benefit recorded in 2012 due to a favorable court judgment on satellite litigation.

Net periodic benefit cost related to pension and other postretirement benefits totaled $2,483 million, $3,769

million and $3,383 million in 2014, 2013 and 2012, respectively. The decrease in 2014 net periodic benefit

cost related to pension is primarily due to lower amortization of actuarial losses due to higher discount

rates which more than offset higher 2014 curtailment charges. The increase in 2013 is primarily due to

higher amortization of actuarial losses and higher service costs driven by lower discount rates.

Unallocated pension expense in 2014 reflects pension charges of $395 million, primarily for pension

curtailment costs. See Note 14. The unallocated pension expense in 2013 reflects a pension curtailment

charge of $73 million related to the decision in September 2013 to end production of the C-17 aircraft in

2015. See Note 11. During the third quarter of 2013 we also determined that the pension expense in prior

years was overstated and recorded a reduction in pension expense of $63 million.

A portion of net periodic benefit cost is recognized in Earnings from operations in the period incurred and

the remainder is included in inventory at the end of the reporting period and recorded in Earnings from

operations in subsequent periods. Costs are allocated to the business segments as described in Note 21.