Boeing 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

on consolidated debt as a percentage of total capital (as defined). When considering debt covenants, we

continue to have substantial borrowing capacity.

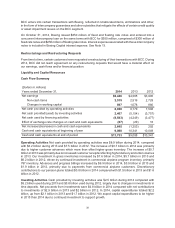

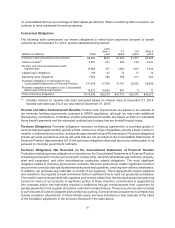

Contractual Obligations

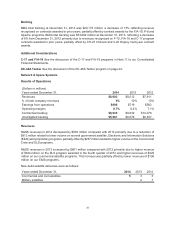

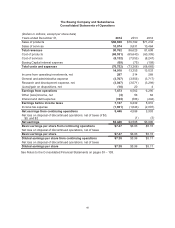

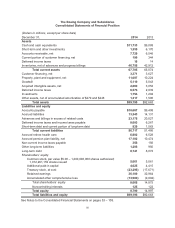

The following table summarizes our known obligations to make future payments pursuant to certain

contracts as of December 31, 2014, and the estimated timing thereof.

(Dollars in millions) Total

Less

than 1

year

1-3

years

3-5

years

After 5

years

Long-term debt (including current portion) $8,950 $870 $1,356 $1,871 $4,853

Interest on debt(1) 5,387 431 800 729 3,427

Pension and other postretirement cash

requirements 10,965 477 1,080 1,972 7,436

Capital lease obligations 169 67 73 17 12

Operating lease obligations 1,503 226 386 271 620

Purchase obligations not recorded on the

Consolidated Statements of Financial Position 131,549 47,249 37,187 20,505 26,608

Purchase obligations recorded on the Consolidated

Statements of Financial Position 16,872 15,959 891 5 17

Total contractual obligations $175,395 $65,279 $41,773 $25,370 $42,973

(1) Includes interest on variable rate debt calculated based on interest rates at December 31, 2014.

Variable rate debt was 3% of our total debt at December 31, 2014.

Pension and Other Postretirement Benefits Pension cash requirements are based on an estimate of

our minimum funding requirements, pursuant to ERISA regulations, although we may make additional

discretionary contributions. Estimates of other postretirement benefits are based on both our estimated

future benefit payments and the estimated contributions to plans that are funded through trusts.

Purchase Obligations Purchase obligations represent contractual agreements to purchase goods or

services that are legally binding; specify a fixed, minimum or range of quantities; specify a fixed, minimum,

variable, or indexed price provision; and specify approximate timing of the transaction. Purchase obligations

include amounts recorded as well as amounts that are not recorded on the Consolidated Statements of

Financial Position. Approximately 4% of the purchase obligations disclosed above are reimbursable to us

pursuant to cost-type government contracts.

Purchase Obligations Not Recorded on the Consolidated Statements of Financial Position

Production related purchase obligations not recorded on the Consolidated Statements of Financial Position

include agreements for inventory procurement, tooling costs, electricity and natural gas contracts, property,

plant and equipment, and other miscellaneous production related obligations. The most significant

obligation relates to inventory procurement contracts. We have entered into certain significant inventory

procurement contracts that specify determinable prices and quantities, and long-term delivery timeframes.

In addition, we purchase raw materials on behalf of our suppliers. These agreements require suppliers

and vendors to be prepared to build and deliver items in sufficient time to meet our production schedules.

The need for such arrangements with suppliers and vendors arises from the extended production planning

horizon for many of our products. A significant portion of these inventory commitments is supported by

firm contracts and/or has historically resulted in settlement through reimbursement from customers for

penalty payments to the supplier should the customer not take delivery. These amounts are also included

in our forecasts of costs for program and contract accounting. Some inventory procurement contracts may

include escalation adjustments. In these limited cases, we have included our best estimate of the effect

of the escalation adjustment in the amounts disclosed in the table above.