Boeing 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

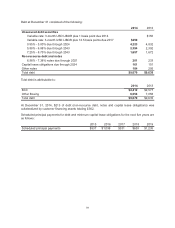

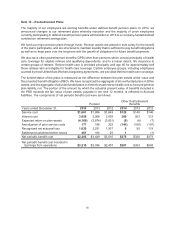

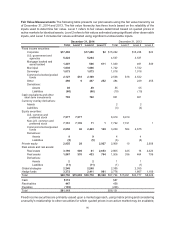

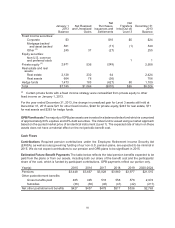

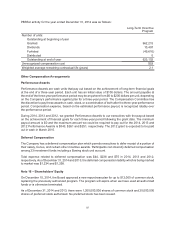

Fair Value Measurements The following table presents our plan assets using the fair value hierarchy as

of December 31, 2014 and 2013. The fair value hierarchy has three levels based on the reliability of the

inputs used to determine fair value. Level 1 refers to fair values determined based on quoted prices in

active markets for identical assets. Level 2 refers to fair values estimated using significant other observable

inputs, and Level 3 includes fair values estimated using significant unobservable inputs.

December 31, 2014 December 31, 2013

Total Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3

Fixed income securities:

Corporate $17,488 $17,486 $2 $15,262 $15,238 $24

U.S. government and

agencies 5,224 5,224 4,537 4,537

Mortgage backed and

asset backed 1,207 596 611 1,040 491 549

Municipal 1,636 1,636 1,722 1,722

Sovereign 1,073 1,073 1,018 1,018

Common/collective/pooled

funds 2,127 $18 2,109 2,538 $16 2,522

Other 498 9 237 252 484 229 255

Derivatives:

Assets 49 49 55 55

Liabilities (66) (66) (10) (10)

Cash equivalents and other

short-term investments 792 792 801 801

Currency overlay derivatives:

Assets 2 2

Liabilities (3) (3)

Equity securities:

U.S. common and

preferred stock 7,577 7,577 6,919 6,919

Non-U.S. common and

preferred stock 7,151 7,139 11 1 7,722 7,721 1

Common/collective/pooled

funds 2,658 46 2,443 169 3,239 564 2,675

Derivatives:

Assets 9944

Liabilities (5) (5) (6) (6)

Private equity 2,955 28 2,927 2,968 10 2,958

Real estate and real assets:

Real estate 3,199 505 41 2,653 2,865 425 16 2,424

Real assets 1,567 370 433 764 1,506 336 464 706

Derivatives:

Assets 2211

Liabilities (11) (11) (1) (1)

Global strategies 2,248 2,248 2,355 2,355

Hedge funds 3,372 2,411 961 2,776 1,667 1,109

Total $60,750 $15,692 $36,718 $8,340 $57,794 $15,991 $33,777 $8,026

Cash $115 $87

Receivables 447 458

Payables (193) (208)

Total $61,119 $58,131

Fixed income securities are primarily valued upon a market approach, using matrix pricing and considering

a security’s relationship to other securities for which quoted prices in an active market may be available,