Boeing 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

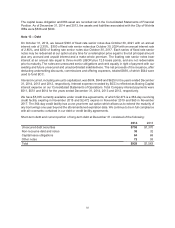

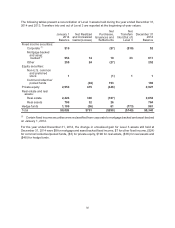

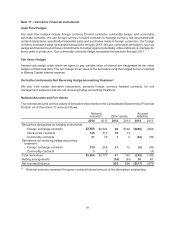

January 1

2013

Balance

Net Realized

and Unrealized

Gains

Net

Purchases,

Issuances and

Settlements

Net

Transfers

Into/(Out of)

Level 3

December 31

2013

Balance

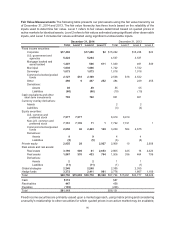

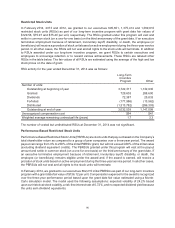

Fixed income securities:

Corporate $3 $16 $5 $24

Mortgage backed

and asset backed 561 (11) (1) 549

Other (2) 245 37 (27) 255

Equity securities:

Non-U.S. common

and preferred stock 11

Private equity (2) 2,671 536 (249) 2,958

Real estate and real

assets:

Real estate 2,128 232 64 2,424

Real assets 664 78 (36) 706

Hedge funds 1,473 183 (627) 80 1,109

Total $7,745 $1,066 ($870) $85 $8,026

(2) Certain private funds with a fixed income strategy were reclassified from private equity to other

fixed income on January 1, 2013.

For the year ended December 31, 2013, the change in unrealized gain for Level 3 assets still held at

December 31, 2013 were $21 for other fixed income, $422 for private equity, $243 for real estate, $71

for real assets and $283 for hedge funds.

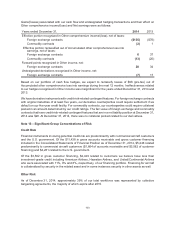

OPB Plan Assets The majority of OPB plan assets are invested in a balanced index fund which is comprised

of approximately 60% equities and 40% debt securities. The index fund is valued using a market approach

based on the quoted market price of an identical instrument (Level 1). The expected rate of return on these

assets does not have a material effect on the net periodic benefit cost.

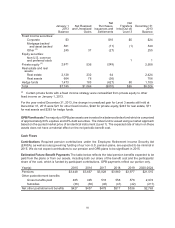

Cash Flows

Contributions Required pension contributions under the Employee Retirement Income Security Act

(ERISA), as well as rules governing funding of our non-U.S. pension plans, are expected to be minimal in

2015. We do not expect contributions to our pension and OPB plans to be significant in 2015.

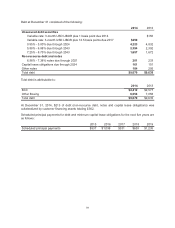

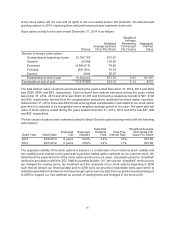

Estimated Future Benefit Payments The table below reflects the total pension benefits expected to be

paid from the plans or from our assets, including both our share of the benefit cost and the participants’

share of the cost, which is funded by participant contributions. OPB payments reflect our portion only.

Year(s) 2015 2016 2017 2018 2019 2020-2024

Pensions $3,448 $3,657 $3,828 $3,960 $3,977 $21,515

Other postretirement benefits:

Gross benefits paid 465 495 518 558 578 2,974

Subsidies (38)(38) (40) (41) (42) (211)

Net other postretirement benefits $427 $457 $478 $517 $536 $2,763