Boeing 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

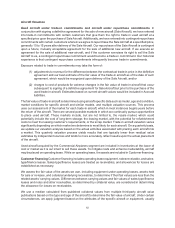

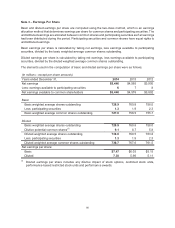

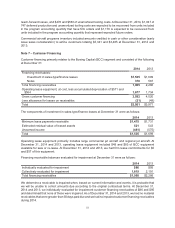

Note 3 – Earnings Per Share

Basic and diluted earnings per share are computed using the two-class method, which is an earnings

allocation method that determines earnings per share for common shares and participating securities. The

undistributed earnings are allocated between common shares and participating securities as if all earnings

had been distributed during the period. Participating securities and common shares have equal rights to

undistributed earnings.

Basic earnings per share is calculated by taking net earnings, less earnings available to participating

securities, divided by the basic weighted average common shares outstanding.

Diluted earnings per share is calculated by taking net earnings, less earnings available to participating

securities, divided by the diluted weighted average common shares outstanding.

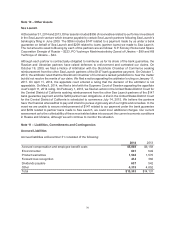

The elements used in the computation of basic and diluted earnings per share were as follows:

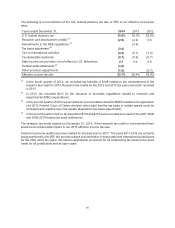

(In millions - except per share amounts)

Years ended December 31, 2014 2013 2012

Net earnings $5,446 $4,585 $3,900

Less: earnings available to participating securities 678

Net earnings available to common shareholders $5,440 $4,578 $3,892

Basic

Basic weighted average shares outstanding 728.9 760.8 758.0

Less: participating securities 1.3 1.9 2.3

Basic weighted average common shares outstanding 727.6 758.9 755.7

Diluted

Basic weighted average shares outstanding 728.9 760.8 758.0

Dilutive potential common shares(1) 9.1 8.7 5.8

Diluted weighted average shares outstanding 738.0 769.5 763.8

Less: participating securities 1.3 1.9 2.3

Diluted weighted average common shares outstanding 736.7 767.6 761.5

Net earnings per share:

Basic $7.47 $6.03 $5.15

Diluted 7.38 5.96 5.11

(1) Diluted earnings per share includes any dilutive impact of stock options, restricted stock units,

performance-based restricted stock units and performance awards.