Boeing 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

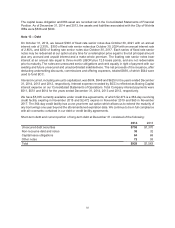

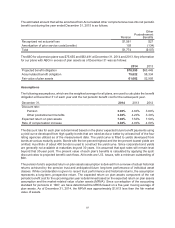

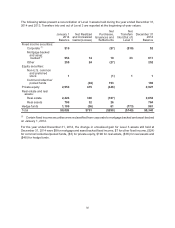

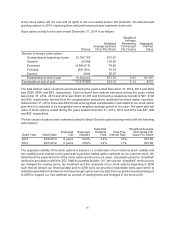

Assumed health care cost trend rates were as follows:

December 31, 2014 2013 2012

Health care cost trend rate assumed next year 7.00% 7.00% 7.50%

Ultimate trend rate 5.00% 5.00% 5.00%

Year that trend reached ultimate rate 2018 2018 2018

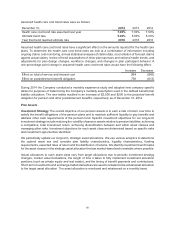

Assumed health care cost trend rates have a significant effect on the amounts reported for the health care

plans. To determine the health care cost trend rates we look at a combination of information including

ongoing claims cost monitoring, annual statistical analyses of claims data, reconciliation of forecast claims

against actual claims, review of trend assumptions of other plan sponsors and national health trends, and

adjustments for plan design changes, workforce changes, and changes in plan participant behavior. A

one-percentage-point change in assumed health care cost trend rates would have the following effect:

Increase Decrease

Effect on total of service and interest cost $54 ($45)

Effect on postretirement benefit obligation 736 (613)

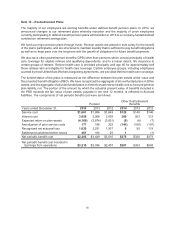

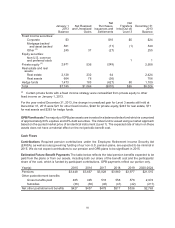

During 2014 the Company conducted a mortality experience study and adopted new company specific

tables for purposes of determining the Company’s mortality assumption used in the defined benefit plan

liability calculation. The new tables resulted in an increase of $2,500 and $200 to the projected benefit

obligation for pension and other postretirement benefits, respectively as of December 31, 2014.

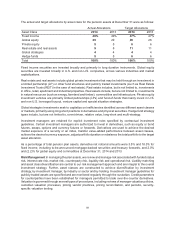

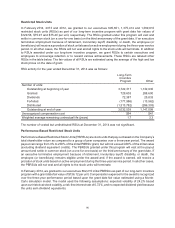

Plan Assets

Investment Strategy The overall objective of our pension assets is to earn a rate of return over time to

satisfy the benefit obligations of the pension plans and to maintain sufficient liquidity to pay benefits and

address other cash requirements of the pension fund. Specific investment objectives for our long-term

investment strategy include reducing the volatility of pension assets relative to pension liabilities, achieving

a competitive, total investment return, achieving diversification between and within asset classes and

managing other risks. Investment objectives for each asset class are determined based on specific risks

and investment opportunities identified.

We periodically update our long-term, strategic asset allocations. We use various analytics to determine

the optimal asset mix and consider plan liability characteristics, liquidity characteristics, funding

requirements, expected rates of return and the distribution of returns. We identify investment benchmarks

for the asset classes in the strategic asset allocation that are market-based and investable where possible.

Actual allocations to each asset class vary from target allocations due to periodic investment strategy

changes, market value fluctuations, the length of time it takes to fully implement investment allocation

positions (such as private equity and real estate), and the timing of benefit payments and contributions.

Short-term investments and exchange-traded derivatives are used to rebalance the actual asset allocation

to the target asset allocation. The asset allocation is monitored and rebalanced on a monthly basis.