Boeing 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

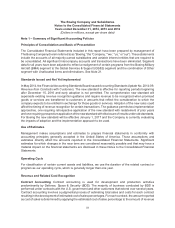

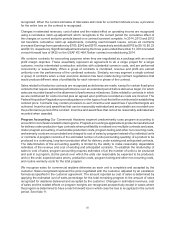

operations. If the fair value is determined to be less than carrying value, a second step is performed to

compute the amount of the impairment. In this process, a fair value for goodwill is estimated, based in part

on the fair value of the operations, and is compared to its carrying value. The shortfall of the fair value

below carrying value represents the amount of goodwill impairment.

Indefinite-lived intangibles consist of brand and trade names acquired in business combinations. We test

these intangibles for impairment by comparing their carrying value to current projections of discounted

cash flows attributable to the brand and trade names. Any excess carrying value over the amount of

discounted cash flows represents the amount of the impairment.

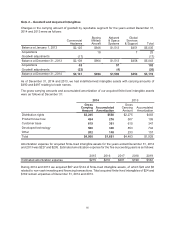

Our finite-lived acquired intangible assets are amortized on a straight-line basis over their estimated useful

lives as follows: developed technology, from 5 to 14 years; product know-how, from 5 to 30 years; customer

base, from 3 to 19 years; distribution rights, from 5 to 27 years; and other, from 3 to 32 years. We evaluate

the potential impairment of finite-lived acquired intangible assets whenever events or changes in

circumstances indicate that the carrying amount may not be recoverable. If the carrying value is no longer

recoverable based upon the undiscounted future cash flows of the asset, the amount of the impairment

is the difference between the carrying amount and the fair value of the asset.

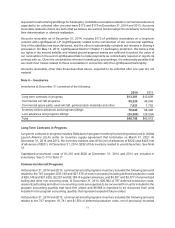

Investments

Time deposits are held-to-maturity investments that are carried at cost.

The equity method of accounting is used to account for investments for which we have the ability to exercise

significant influence, but not control, over an investee. Significant influence is generally deemed to exist

if we have an ownership interest in the voting stock of an investee of between 20% and 50%.

We classify investment income and loss on our Consolidated Statements of Operations based on whether

the investment is operating or non-operating in nature. Operating investments align strategically and are

integrated with our operations. Earnings from operating investments, including our share of income or loss

from equity method investments, dividend income from certain cost method investments, and any

impairments or gain/loss on the disposition of these investments, are recorded in Income from operating

investments, net. Non-operating investments are those we hold for non-strategic purposes. Earnings from

non-operating investments, including interest and dividends on marketable securities, and any impairments

or gain/loss on the disposition of these investments are recorded in Other income/(expense), net.

Derivatives

All derivative instruments are recognized in the financial statements and measured at fair value regardless

of the purpose or intent of holding them. We use derivative instruments to principally manage a variety of

market risks. For derivatives designated as hedges of the exposure to changes in fair value of the recognized

asset or liability or a firm commitment (referred to as fair value hedges), the gain or loss is recognized in

earnings in the period of change together with the offsetting loss or gain on the hedged item attributable

to the risk being hedged. The effect of that accounting is to include in earnings the extent to which the

hedge is not effective in achieving offsetting changes in fair value. For our cash flow hedges, the effective

portion of the derivative’s gain or loss is initially reported in comprehensive income and is subsequently

reclassified into earnings in the same period or periods during which the hedged forecasted transaction

affects earnings. The ineffective portion of the gain or loss of a cash flow hedge is reported in earnings

immediately. We also hold certain instruments for economic purposes that are not designated for hedge

accounting treatment. For these derivative instruments, the changes in their fair value are also recorded

in earnings immediately.