Boeing 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

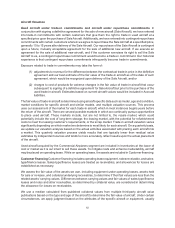

52

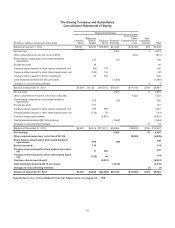

The Boeing Company and Subsidiaries

Consolidated Statements of Equity

Boeing shareholders

(Dollars in millions, except per share data)

Common

Stock

Additional

Paid-In

Capital

Treasury

Stock

Retained

Earnings

Accumulated

Other

Comprehensive

Loss

Non-

controlling

Interest Total

Balance at January 1, 2012 $5,061 $4,033 ($16,603) $27,524 ($16,500)$93 $3,608

Net earnings 3,900 3 3,903

Other comprehensive loss, net of tax of $536 (916) (916)

Share-based compensation and related dividend

equivalents 215 (27) 188

Excess tax pools 45 45

Treasury shares issued for stock options exercised, net (54)174 120

Treasury shares issued for other share-based plans, net (183)116 (67)

Treasury shares issued for 401(k) contribution 66 376 442

Cash dividends declared ($1.805 per share) (1,360) (1,360)

Changes in noncontrolling interests 44

Balance at December 31, 2012 $5,061 $4,122 ($15,937) $30,037 ($17,416)$100 $5,967

Net earnings 4,585 9 4,594

Other comprehensive income, net of tax of ($4,246) 7,522 7,522

Share-based compensation and related dividend

equivalents 216 (16) 200

Excess tax pools 101 101

Treasury shares issued for stock options exercised, net 109 988 1,097

Treasury shares issued for other share-based plans, net (133) 79 (54)

Common shares repurchased (2,801) (2,801)

Cash dividends declared ($2.185 per share) (1,642) (1,642)

Changes in noncontrolling interests 13 13

Balance at December 31, 2013 $5,061 $4,415 ($17,671) $32,964 ($9,894) $122 $14,997

Net earnings 5,446 10 5,456

Other comprehensive loss, net of tax of $2,199 (4,009) (4,009)

Share-based compensation and related dividend

equivalents 208 (20) 188

Excess tax pools 114 114

Treasury shares issued for stock options exercised,

net 17 326 343

Treasury shares issued for other share-based plans,

net (129) 48 (81)

Common shares repurchased (6,001) (6,001)

Cash dividends declared ($3.10 per share) (2,210) (2,210)

Changes in noncontrolling interests (7) (7)

Balance at December 31, 2014 $5,061 $4,625 ($23,298) $36,180 ($13,903)$125 $8,790

See Notes to the Consolidated Financial Statements on pages 53 – 108.