Boeing 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148

|

|

67

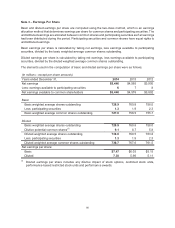

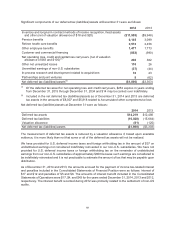

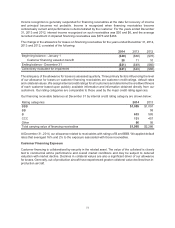

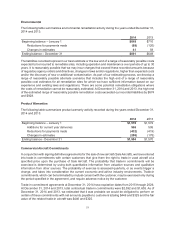

The following table includes the number of shares that may be dilutive potential common shares in the

future. These shares were not included in the computation of diluted earnings per share because the effect

was either antidilutive or the performance condition was not met.

(Shares in millions)

Years ended December 31, 2014 2013 2012

Stock options 4.8 23.6

Performance awards 5.1 4.2 4.9

Performance-based restricted stock units 1.3

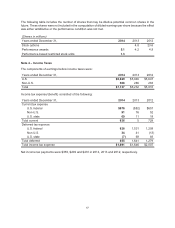

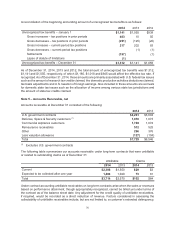

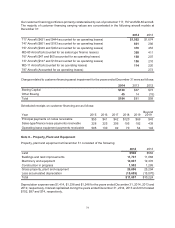

Note 4 – Income Taxes

The components of earnings before income taxes were:

Years ended December 31, 2014 2013 2012

U.S. $6,829 $5,946 $5,647

Non-U.S. 308 286 263

Total $7,137 $6,232 $5,910

Income tax expense/(benefit) consisted of the following:

Years ended December 31, 2014 2013 2012

Current tax expense

U.S. federal $676 ($82) $657

Non-U.S. 91 76 52

U.S. state 69 11 19

Total current 836 5 728

Deferred tax expense

U.S. federal 828 1,531 1,209

Non-U.S. 34 41 (13)

U.S. state (7) 69 83

Total deferred 855 1,641 1,279

Total income tax expense $1,691 $1,646 $2,007

Net income tax payments were $355, $209 and $410 in 2014, 2013 and 2012, respectively.