Boeing 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

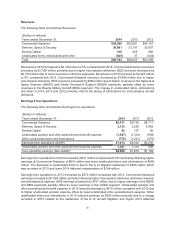

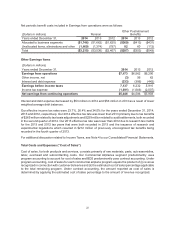

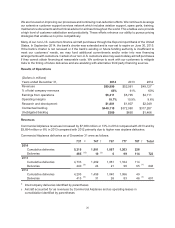

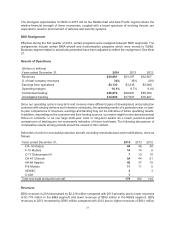

increase in contractual backlog at December 31, 2014 compared with December 31, 2013 was primarily

due to commercial airplane orders and reclassifications from unobligated backlog related to incremental

funding. The increase was partially offset by commercial airplane deliveries and revenues recognized on

awarded contracts. The increase in contractual backlog during 2013 was primarily due to commercial

aircraft orders in excess of deliveries partially offset by cancellation of orders.

Unobligated backlog includes U.S. and non-U.S. government definitive contracts for which funding has

not been authorized. The unobligated backlog at December 31, 2014 decreased from December 31, 2013

primarily due to reclassifications to contractual backlog related to incremental funding for BDS contracts,

partially offset by contract awards. The unobligated backlog increased during 2013 compared to 2012

primarily due to CH-47 Chinook and V-22 Osprey multi-year contract awards. The increase was partially

offset by reclassifications to contractual backlog related to incremental funding for the U.S. Air Force

KC-46A Tanker and F-15 multi-year contracts.

Additional Considerations

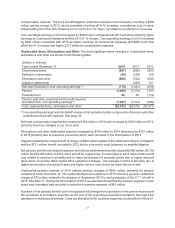

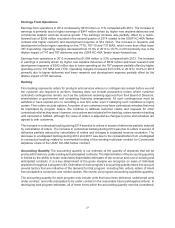

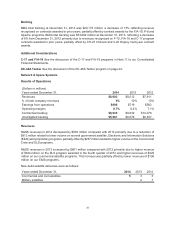

KC-46A Tanker In 2011, we were awarded a contract from the U.S. Air Force (USAF) to design, develop,

manufacture and deliver four next generation aerial refueling tankers. The KC-46A Tanker is a derivative

of our 767 commercial aircraft. This contract is a fixed-price incentive fee contract valued at $4.9 billion

and involves highly complex designs and systems integration. During the second quarter of 2014, we

recorded a reach-forward loss of $425 million on this contract. $238 million of this loss was recorded at

our Commercial Airplanes segment and the remaining $187 million was recorded in our BMA segment.

The reach-forward loss was primarily due to initial engineering and design issues discovered during

systems installation that are requiring rework and additional engineering and manufacturing labor to

complete this contract. To date the program has met all customer contractual milestones.

This contract contains production options. If all options under the contract are exercised, we expect to

deliver 179 aircraft for a total expected contract value of approximately $30 billion. The USAF is scheduled

to authorize low rate initial production in 2015 subject to satisfactory progress being made on the

development contract.

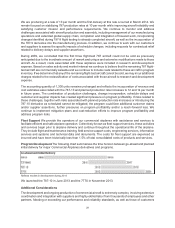

Russia/Ukraine We continue to monitor political unrest involving Russia and Ukraine, where we and some

of our suppliers source titanium products and/or have operations. A number of our commercial customers

also have operations in Russia and Ukraine. To date, we have not experienced any significant disruptions

to production or deliveries. Should suppliers or customers experience disruption, our production and/or

deliveries could be materially impacted.

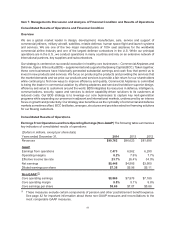

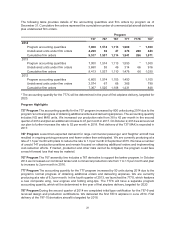

Segment Results of Operations and Financial Condition

Commercial Airplanes

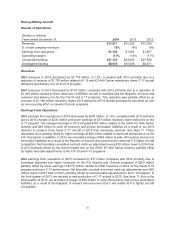

Business Environment and Trends

Airline Industry Environment Global economic activity and global trade, which are the primary drivers

of the demand for air travel, grew below the long-term average for the third year in a row in 2014. Despite

this, passenger traffic grew from 5% to 6% annually between 2012 and 2014 and is forecasted to continue

above the long-term trend of 5% in 2015. There continues to be significant variation between regions and

airline business models, with airlines operating in emerging economies and low-cost-carriers leading

growth.