Boeing 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

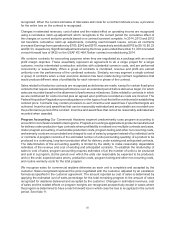

determination is made. Tax-related interest and penalties are classified as a component of Income tax

expense.

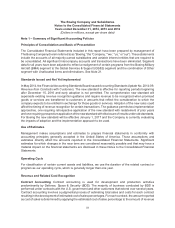

Postretirement Plans

The majority of our employees are earning benefits under defined benefit pension plans. In 2014, we

announced changes to our retirement plans whereby nonunion and the majority of union employees

currently participating in defined benefit pension plans will transition in 2016 to a company-funded defined

contribution retirement savings plan. We also provide postretirement benefit plans other than pensions,

consisting principally of health care coverage to eligible retirees and qualifying dependents. Benefits under

the pension and other postretirement benefit plans are generally based on age at retirement and years of

service and, for some pension plans, benefits are also based on the employee’s annual earnings. The net

periodic cost of our pension and other postretirement plans is determined using the projected unit credit

method and several actuarial assumptions, the most significant of which are the discount rate, the long-

term rate of asset return, and medical trend (rate of growth for medical costs). A portion of net periodic

pension and other postretirement income or expense is not recognized in net earnings in the year incurred

because it is allocated to production as product costs, and reflected in inventory at the end of a reporting

period. Actuarial gains and losses, which occur when actual experience differs from actuarial assumptions,

are reflected in Shareholders’ equity (net of taxes). If actuarial gains and losses exceed ten percent of the

greater of plan assets or plan liabilities we amortize them over the average future service period of

employees. The funded status of our pension and postretirement plans is reflected on the Consolidated

Statements of Financial Position.

Postemployment Plans

We record a liability for postemployment benefits, such as severance or job training, when payment is

probable, the amount is reasonably estimable, and the obligation relates to rights that have vested or

accumulated.

Environmental Remediation

We are subject to federal and state requirements for protection of the environment, including those for

discharge of hazardous materials and remediation of contaminated sites. We routinely assess, based on

in-depth studies, expert analyses and legal reviews, our contingencies, obligations, and commitments for

remediation of contaminated sites, including assessments of ranges and probabilities of recoveries from

other responsible parties and/or insurance carriers. Our policy is to accrue and charge to current expense

identified exposures related to environmental remediation sites when it is probable that a liability has been

incurred and the amount can be reasonably estimated. The amount of the liability is based on our best

estimate or the low end of a range of reasonably possible exposure for investigation, cleanup, and

monitoring costs to be incurred. Estimated remediation costs are not discounted to present value as the

timing of payments cannot be reasonably estimated. We may be able to recover a portion of the remediation

costs from insurers or other third parties. Such recoveries are recorded when realization of the claim for

recovery is deemed probable.

Cash and Cash Equivalents

Cash and cash equivalents consist of highly liquid instruments, such as commercial paper, time deposits,

and other money market instruments, which have original maturities of three months or less. We aggregate

our cash balances by bank where conditions for right of set-off are met, and reclassify any negative

balances, consisting mainly of uncleared checks, to Accounts payable. Negative balances reclassified to

Accounts payable were $241 and $108 at December 31, 2014 and 2013.