Boeing 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

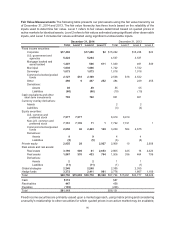

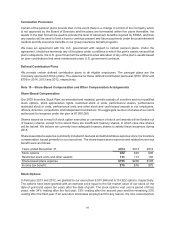

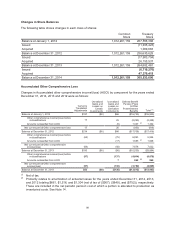

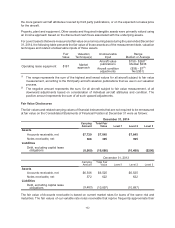

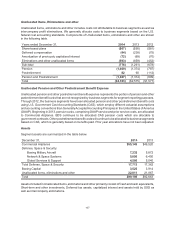

Gains/(losses) associated with our cash flow and undesignated hedging transactions and their effect on

Other comprehensive income/(loss) and Net earnings were as follows:

Years ended December 31, 2014 2013

Effective portion recognized in Other comprehensive income/(loss), net of taxes:

Foreign exchange contracts ($135) ($76)

Commodity contracts (2) 1

Effective portion reclassified out of Accumulated other comprehensive loss into

earnings, net of taxes:

Foreign exchange contracts 637

Commodity contracts (13) (20)

Forward points recognized in Other income, net:

Foreign exchange contracts 28 34

Undesignated derivatives recognized in Other income, net:

Foreign exchange contracts (7) 17

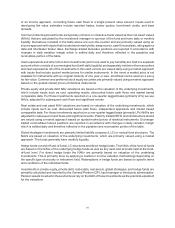

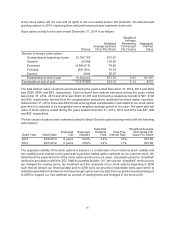

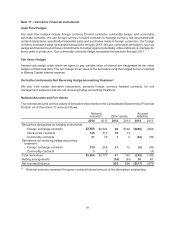

Based on our portfolio of cash flow hedges, we expect to reclassify losses of $98 (pre-tax) out of

Accumulated other comprehensive loss into earnings during the next 12 months. Ineffectiveness related

to our hedges recognized in Other income was insignificant for the years ended December 31, 2014 and

2013.

We have derivative instruments with credit-risk-related contingent features. For foreign exchange contracts

with original maturities of at least five years, our derivative counterparties could require settlement if we

default on our five-year credit facility. For commodity contracts, our counterparties could require collateral

posted in an amount determined by our credit ratings. The fair value of foreign exchange and commodity

contracts that have credit-risk-related contingent features that are in a net liability position at December 31,

2014 was $20. At December 31, 2014, there was no collateral posted related to our derivatives.

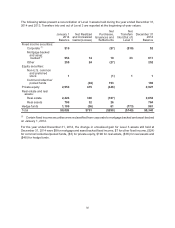

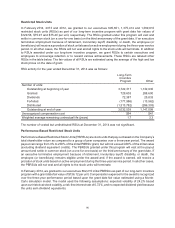

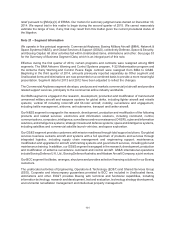

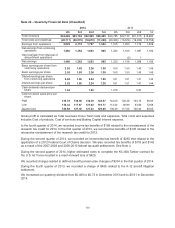

Note 18 – Significant Group Concentrations of Risk

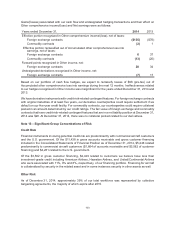

Credit Risk

Financial instruments involving potential credit risk are predominantly with commercial aircraft customers

and the U.S. government. Of the $11,438 in gross accounts receivable and gross customer financing

included in the Consolidated Statements of Financial Position as of December 31, 2014, $5,246 related

predominantly to commercial aircraft customers ($1,664 of accounts receivable and $3,582 of customer

financing) and $4,281 related to the U.S. government.

Of the $3,582 in gross customer financing, $2,429 related to customers we believe have less than

investment-grade credit including American Airlines, Hawaiian Airlines, and United/Continental Airlines

who were associated with 11%, 9% and 8%, respectively, of our financing portfolio. Financing for aircraft

is collateralized by security in the related asset and in some instances security in other assets as well.

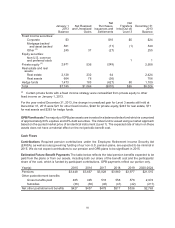

Other Risk

As of December 31, 2014, approximately 39% of our total workforce was represented by collective

bargaining agreements, the majority of which expire after 2015.