Avon 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of loss that could result from unfavorable outcomes but, under

some circumstances, adverse awards could be material to our

consolidated financial position, results of operations or

cash flows.

We are voluntarily conducting an internal investigation of our

China operations, focusing on compliance with the Foreign

Corrupt Practices Act. The internal investigation, which is being

conducted under the oversight of the Audit Committee,

commenced in June 2008 after we received an allegation that

certain travel, entertainment and other expenses may have been

improperly incurred in connection with our China operations.

We have voluntarily contacted the Securities and Exchange

Commission and the United States Department of Justice to

advise both agencies that an internal investigation is underway.

Because the internal investigation is in its early stage, we cannot

predict how the resulting consequences, if any, may impact our

internal controls, business, results of operations or

financial position.

Various other lawsuits and claims, arising in the ordinary course

of business or related to businesses previously sold, are pending

or threatened against Avon. In management’s opinion, based on

its review of the information available at this time, the total cost

of resolving such other contingencies at December 31, 2008,

should not have a material adverse effect on our consolidated

financial position, results of operations or cash flows.

NOTE 16. Goodwill and Intangible

Assets

On April 2, 2007, we acquired our licensee in Egypt for approx-

imately $17 in cash. The acquired business is being operated by

a new wholly-owned subsidiary and is included in our Western

Europe, Middle East & Africa operating segment. The purchase

price allocation resulted in goodwill of $9.3 and customer

relationships of $1.0 with a seven-year useful life.

In August 2006, we purchased all of the remaining 6.155%

outstanding shares in our two joint-venture subsidiaries in China

from the minority interest shareholders for approximately $39.1.

We previously owned 93.845% of these subsidiaries and con-

solidated their results, while recording minority interest for the

portion not owned. Upon completion of the transaction, we

eliminated the minority interest in the net assets of these sub-

sidiaries. The purchase of these shares did not have a material

impact on our consolidated net income. Avon China is a stand-

alone operating segment. The purchase price allocation resulted

in goodwill of $33.3 and customer relationships of $1.9 with a

ten-year weighted-average useful life.

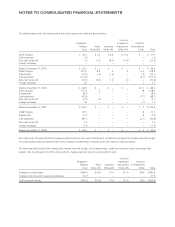

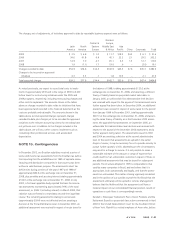

Goodwill

Latin

America

Western

Europe,

Middle East

& Africa

Central

& Eastern

Europe

Asia

Pacific China Total

Balance at December 31, 2007 $94.9 $37.8 $8.8 $10.4 $70.3 $222.2

Adjustments – .3 – – – .3

Foreign exchange – (4.8) – 2.0 4.8 2.0

Balance at December 31, 2008 $94.9 $33.3 $8.8 $12.4 $75.1 $224.5

A V O N 2008 F-33