Avon 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

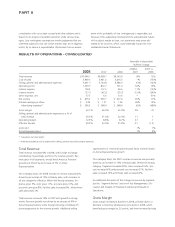

• the automation of certain distribution processes;

• the exit of certain unprofitable operations, including the clo-

sure of the Avon Salon & Spa, the closure of our operations in

Indonesia, the exit of a product line in China and the exit of

the beComing product line in the U.S.; and

• the reorganization of certain functions, primarily sales-related

organizations.

Actions implemented under these restructuring initiatives

resulted in savings of approximately $270 in 2008, as compared

to savings of approximately $230 in 2007. We expect to achieve

annualized savings of approximately $430 once all initiatives are

fully implemented by 2011-2012. We expect the savings to

reach approximately $300 in 2009.

2009 Restructuring Program

In February 2009, we announced a new restructuring program

under our multi-year turnaround plan (the “2009 Program”).

The restructuring initiatives under the 2009 Program are

expected to focus on restructuring our global supply chain

operations, realigning certain local business support functions to

a more regional basis to drive increased efficiencies, and stream-

lining transaction-related services, including selective outsourc-

ing. We expect to incur restructuring charges and other costs to

implement these initiatives in the range of $300 to $400 before

taxes over the next several years. We are targeting annualized

savings under the 2009 Program of approximately $200 upon

full implementation by 2012-2013.

See Note 14, Restructuring Initiatives, on pages F-28 through

F-31 of this 2008 Annual Report on Form 10-K.

NEW ACCOUNTING STANDARDS

Information relating to new accounting standards is included

Note 2, New Accounting Standards, on pages F-10 through F-11

of this 2008 Annual Report on Form 10-K.

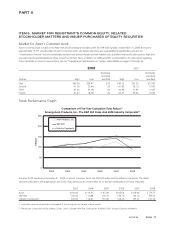

Key Performance Indicators

Within the following discussion and analysis, we utilize the key performance indicators (“KPIs”) defined below to assist in the evaluation of

our business.

KPI Definition

Growth in Active Representatives This indicator is based on the number of Representatives submitting an order in a campaign,

totaled for all campaigns in the related period. This amount is divided by the number of bill-

ing days in the related period, to exclude the impact of year-to-year changes in billing days

(for example, holiday schedules). To determine the growth in Active Representatives, this

calculation is compared to the same calculation in the corresponding period of the prior

year.

Change in Units This indicator is based on the gross number of pieces of merchandise sold during a period,

as compared to the same number in the same period of the prior year. Units sold include

samples sold and product contingent upon the purchase of another product (for example,

gift with purchase or purchase with purchase), but exclude free samples.

Inventory Days This indicator is equal to the number of days of historical cost of sales covered by the

inventory balance at the end of the period.

CRITICAL ACCOUNTING ESTIMATES

We believe the accounting policies described below represent

our critical accounting policies due to the estimation processes

involved in each. See Note 1, Description of the Business and

Summary of Significant Accounting Policies, for a detailed dis-

cussion of the application of these and other accounting policies.

Restructuring Reserves

We record severance-related expenses once they are both prob-

able and estimable in accordance with the provisions of FAS

No. 112, Employer’s Accounting for Post-Employment Benefits,

for severance provided under an ongoing benefit arrangement.

One-time, involuntary benefit arrangements and disposal costs,

primarily contract termination costs, are accounted for under the

provisions of FAS No. 146, Accounting for Costs Associated with

Exit or Disposal Activities. One-time, voluntary benefit arrange-

ments are accounted for under the provisions of FAS No. 88,

Employers’ Accounting for Settlements and Curtailments of

Defined Benefit Pension Plans and for Termination Benefits.We

evaluate impairment issues under the provisions of FAS No. 144,

Accounting for the Impairment or Disposal of Long-Lived Assets.

We estimate the expense for these initiatives, when approved by

A V O N 2008 23