Avon 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

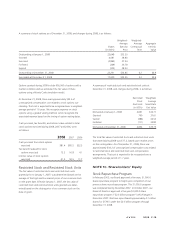

In December 2007, the FASB issued SFAS No. 160, Noncontrol-

ling Interests in Consolidated Financial Statements, (“SFAS

160”), which changes the accounting and reporting standards

for the noncontrolling interests in a subsidiary in consolidated

financial statements. SFAS 160 recharacterizes minority interests

as noncontrolling interests and requires noncontrolling interests

to be classified as a component of shareholders’ equity. SFAS

160 is effective January 1, 2009, for Avon and requires retro-

active adoption of the presentation and disclosure requirements

for existing minority interests. We do not believe the adoption of

SFAS 160 will have a material impact on our consolidated finan-

cial statements. At December 31, 2008 and 2007, other liabilities

included minority interest liabilities of $37.4 and $38.2,

respectively.

NOTE 3. Inventories

Inventories at December 31 consisted of the following:

2008 2007

Raw materials $ 292.7 $ 337.8

Finished goods 715.2 704.0

Total $1,007.9 $1,041.8

NOTE 4. Debt and Other Financing

Debt

Debt at December 31 consisted of the following:

2008 2007

Debt maturing within one year:

Notes payable $ 125.4 $ 76.0

Commercial paper 499.7 701.6

Yen credit facility 102.0 96.3

Euro credit facility – 32.8

7.15% Notes, due November 2009 300.0 –

Current portion of long-term debt 4.3 22.8

Total $1,031.4 $ 929.5

Long-term debt:

7.15% Notes, due November 2009 $ – $ 300.0

5.125% Notes, due January 2011 499.7 499.6

4.80% Notes, due March 2013 249.2 –

4.625% Notes, due May 2013 114.1 112.0

5.75% Notes, due March 2018 249.2 –

4.20% Notes, due July 2018 249.7 249.1

Other, payable through 2013 with

interest from 1.4% to 25.3% 14.7 31.0

Total long-term debt 1,376.6 1,191.7

Adjustments for debt with fair value

hedges 83.9 (1.0)

Less current portion (4.3) (22.8)

Total $1,456.2 $1,167.9

At December 31, 2008 and 2007, notes payable included

short-term borrowings of international subsidiaries at average

annual interest rates of approximately 7.6% and 4.6%,

respectively.

At December 31, 2008 and 2007, other long-term debt, payable

through 2013, included obligations under capital leases of $11.4

and $13.6, respectively, which primarily relate to leases of auto-

mobiles and equipment.

Adjustments for debt with fair value hedges includes adjust-

ments to reflect net unrealized gains of $80.0 and losses of $9.4

on debt with fair value hedges at December 31, 2008 and 2007,

respectively, and unamortized gains on terminated swap

agreements and swap agreements no longer designated as fair

value hedges of $3.9 and $8.4 at December 31, 2008 and 2007,

respectively (see Note 7, Financial Instruments and Risk

Management).

At December 31, 2008 and 2007, we held interest rate swap

contracts that swap approximately 50% and 30%, respectively,

of our long-term debt to variable rates (see Note 7, Financial

Instruments and Risk Management).

In March 2008, we issued $500.0 principal amount of notes

payable in a public offering. $250.0 of the notes bear interest at

a per annum coupon rate equal to 4.80%, payable semi-

annually, and mature on March 1, 2013, unless previously

redeemed (the “2013 Notes”). $250.0 of the notes bear interest

at a per annum coupon rate of 5.75%, payable semi-annually,

and mature on March 1, 2018, unless previously redeemed (the

“2018 Notes”). The net proceeds from the offering of $496.3

were used to repay outstanding indebtedness under our

commercial paper program and for general corporate purposes.

The carrying value of the 2013 Notes represents the $250.0

principal amount, net of the unamortized discount to face value

of $.8 at December 31, 2008. The carrying value of the 2018

Notes represents the $250.0 principal amount, net of the unam-

ortized discount to face value of $.8 at December 31, 2008.

In January 2006, we issued in a public offering $500.0 principal

amount of notes payable (“5.125% Notes”) that mature on

January 15, 2011, and bear interest, payable semi-annually, at a

per annum rate equal to 5.125%. The net proceeds from the

offering were used for general corporate purposes, including the

repayment of short-term domestic debt. The carrying value of

the 5.125% Notes represents the $500.0 principal amount, net

of the unamortized discount to face value of $.3 and $.4 at

December 31, 2008 and 2007, respectively.

In June 2003, we issued to the public $250.0 principal amount

of registered senior notes (the “4.20% Notes”) under our

A V O N 2008 F-11