Avon 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

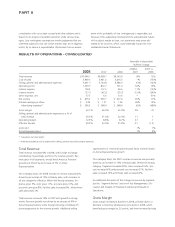

Net Cash Used by Financing Activities

Net cash used by financing activities during 2008 was $455.6

lower than during 2007, primarily due to lower repurchases of

common stock during 2008.

Net cash used by financing activities in 2007 was $106.7 higher

than in 2006, mainly driven by higher repurchases of common

stock during 2007, partially offset by higher short-term borrow-

ings and higher proceeds from stock option exercises during

2007.

We purchased approximately 4.6 million shares of Avon com-

mon stock for $172.1 during 2008, as compared to approx-

imately 17.3 million shares of Avon common stock for $666.8

during 2007 and approximately 11.6 million shares of Avon

common stock for $355.1 during 2006, under our previously

announced share repurchase programs and through acquisition

of stock from employees in connection with tax payments upon

vesting of restricted stock units. In October 2007, the Board of

Directors authorized the repurchase of $2,000.0 of our common

stock over a five-year period, which began in December 2007.

We increased our quarterly dividend payments to $.20 per share

in 2008 from $.185 per share in 2007. In February 2009, our

Board approved an increase in the quarterly dividend to

$.21 per share.

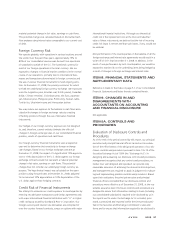

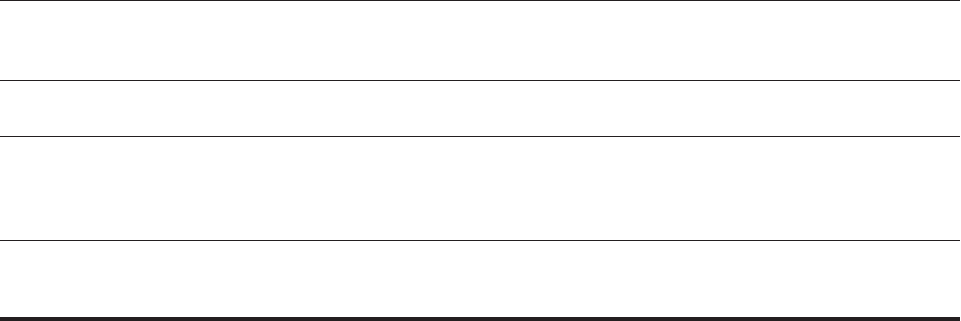

Debt and Contractual Financial Obligations and Commitments

At December 31, 2008, our debt and contractual financial obligations and commitments by due dates were as follows:

2009 2010 2011 2012 2013

2014 and

Beyond Total

Short-term debt $1,027.1 $ – $ – $ – $ – $ – $1,027.1

Long-term debt – – 500.0 – 375.0 500.0 1,375.0

Capital lease obligations 4.3 4.3 2.8 2.5 0.8 – 14.7

Total debt 1,031.4 4.3 502.8 2.5 375.8 500.0 2,416.8

Debt-related interest 90.7 68.9 55.8 42.8 33.8 63.0 355.0

Total debt-related 1,122.1 73.2 558.6 45.3 409.6 563.0 2,771.8

Operating leases 87.9 61.6 42.7 21.8 17.0 45.6 276.6

Purchase obligations 106.3 55.3 25.8 17.7 16.1 49.9 271.1

Benefit obligations(1) 77.4 13.9 11.6 10.4 11.3 50.4 175.0

Total debt and contractual

financial obligations and

commitments(2) $1,393.7 $204.0 $638.7 $95.2 $454.0 $708.9 $3,494.5

(1) Amounts represent expected future benefit payments for our unfunded pension and postretirement benefit plans, as well as expected contributions for 2009

to our funded pension benefit plans.

(2) The amount of debt and contractual financial obligations and commitments excludes amounts due pursuant to derivative transactions. The table also excludes

information on recurring purchases of inventory as these purchase orders are non-binding, are generally consistent from year to year, and are short-term in

nature. The table does not include any reserves for income taxes under FIN 48 because we are unable to reasonably predict the ultimate amount or timing of

settlement of our reserves for income taxes. At December 31, 2008, our reserves for income taxes, including interest and penalties, totaled $118.3.

See Note 4, Debt and Other Financing, and Note 13, Leases and Commitments, for further information on our debt and contractual financial

obligations and commitments. Additionally, as disclosed in Note 14, Restructuring Initiatives, we have a remaining liability of $93.9 at

December 31, 2008, associated with the restructuring charges recorded to date, and we also expect to record additional restructuring

charges of $21.9 in future periods to implement the actions approved to date. The significant majority of these liabilities will require cash

payments during 2009.

Off Balance Sheet Arrangements

At December 31, 2008, we had no material off-balance-sheet

arrangements.

Capital Resources

We have a five-year, $1,000.0 revolving credit and competitive

advance facility (the “credit facility”), which expires in January

2011. The credit facility may be used for general corporate

purposes. The interest rate on borrowings under this credit

facility is based on LIBOR or on the higher of prime or

1

⁄

2

% plus

the federal funds rate. The credit facility has an annual fee of

$.7, payable quarterly, based on our current credit ratings. The

credit facility contains various covenants, including a financial

covenant which requires Avon’s interest coverage ratio

A V O N 2008 35