Avon 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The results in China for 2008 were negatively impacted by the

earthquake and subsequent flooding that occurred during the

second quarter of 2008.

The increase in operating margin for 2008 was primarily driven

by the impact of higher revenue and lower product costs, parti-

ally offset by ongoing higher spending on RVP and advertising

and costs associated with the 2008 earthquake and floods.

Operating margin for 2007 benefited from higher reductions in

reserves for statutory liabilities.

For information concerning an internal investigation into our

China operations, see Risk Factors and Note 15, Contingencies.

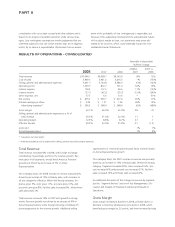

China – 2007 Compared to 2006

%/Point Change

2007 2006 US$

Local

Currency

Total revenue $280.5 $211.8 32% 26%

Operating profit 2.0 (10.8) * *

Operating margin .7% (5.1)% 5.8 5.5

Units sold 19%

Active Representatives 145%

* Calculation not meaningful

Total revenue in China increased significantly in 2007, primarily

due to an increase in Active Representatives reflecting further

expansion of the direct-selling business, which contributed over

one half of the region’s revenue in 2007. Active Representatives

increased significantly in 2007 due to Representative recruiting,

as well as the absence of a meaningful base comparison for the

first half of 2006. The lower average order was mainly due to a

higher share of sales from new Representatives. At the same

time that we have been building on direct selling, we have seen

ordering activity levels maintained by our beauty boutiques as

they continue to engage in direct selling by servicing our Repre-

sentatives. Additionally, the number of beauty boutiques has

remained stable over the last year. Revenue in 2007 benefited

from representative recruiting and continued significant invest-

ments in advertising.

The increase in operating margin for 2007 was primarily driven

by the impact of higher revenue and a reduction of a reserve for

statutory liabilities. These positive impacts were partially offset by

ongoing higher spending on RVP and fees paid to registered

service centers for providing services to our Active

Representatives.

LIQUIDITY AND CAPITAL RESOURCES

Our principal sources of funds historically have been cash flows

from operations, commercial paper and borrowings under lines

of credit. We currently believe that existing cash, cash from

operations (including the impacts of cash required for restructur-

ing initiatives) and available sources of public and private financ-

ing are adequate to meet anticipated requirements for working

capital, dividends, capital expenditures, the share repurchase

program, possible acquisitions and other cash needs in the short

and long term.

We may, from time to time, seek to repurchase our equity in

open market purchases, privately negotiated transactions, pur-

suant to derivative instruments or otherwise. During 2008, we

repurchased approximately 4.6 million shares of our common

stock for an aggregate purchase price of approximately $172.

Retirements of debt will depend on prevailing market conditions,

our liquidity requirements, contractual restrictions and other

factors, and the amounts involved may be material. We may also

elect to incur additional debt or issue equity or convertible secu-

rities to finance ongoing operations, acquisitions or to meet our

other liquidity needs.

Any issuances of equity securities or convertible securities could

have a dilutive effect on the ownership interest of our current

shareholders and may adversely impact earnings per share in

future periods.

Our liquidity could also be impacted by dividends, capital expen-

ditures and acquisitions. At any given time, we may be in the

process of discussing and negotiating an acquisition. An acquisi-

tion may be accretive or dilutive and by its nature, involve num-

erous risks and uncertainties. See our Cautionary Statement for

purposes of the “Safe Harbor” Statement under the Private

Securities Litigation Reform Act of 1995.

While recent turmoil in global financial markets has limited

access to capital for many companies, in 2008 we did not

experience any limitations in issuing commercial paper, reflecting

our investment-grade credit rating (Standard and Poor’s rating of

single A and Moody’s rating of A2). In addition, our commercial

paper program is fully supported by a revolving line of credit,

which is described below under “Capital Resources”. Manage-

ment is not aware of any issues currently impacting our lenders’

ability to honor their commitment to extend credit under the

revolving line of credit. It is unclear the extent to which this

credit crisis will persist and what overall impact it may have

on Avon.

A V O N 2008 33