Avon 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

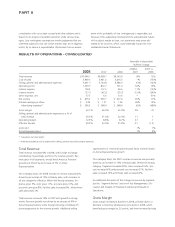

Balance Sheet Data

2008 2007

Cash and cash equivalents $1,104.7 $ 963.4

Total debt 2,487.6 2,097.4

Working capital 644.7 462.0

Cash Flows

2008 2007 2006

Net cash provided by

operating activities $ 748.1 $ 589.8 $ 796.1

Net cash used by investing

activities (403.4) (287.2) (207.9)

Net cash used by financing

activities (141.5) (597.1) (490.4)

Effect of exchange rate

changes on cash and

equivalents (61.9) 59.0 42.4

Net Cash Provided by Operating Activities

Net cash provided by operating activities during 2008 was

$158.3 higher than during 2007, primarily due to higher cash-

related net income in 2008, favorable impacts of inventory and

accounts receivable balances and lower contributions to retire-

ment-related plans in 2008. These cash inflows were partially

offset by the unfavorable impact of the accounts payable bal-

ance, additional payments of value added taxes due to a tax law

change in Brazil that we began to recover during the fourth

quarter of 2008, higher incentive-based compensation payments

in 2008 related to our 2006-2007 Turnaround Incentive Plan and

a payment of $38.0 upon settlement of treasury lock agree-

ments associated with our $500 debt issuance during the first

quarter of 2008.

Inventory levels decreased during 2008, to $1,007.9 at Decem-

ber 31, 2008, from $1,041.8 at December 31, 2007, reflecting

the impact of foreign exchange, partially offset by business

growth and revenue declines in North America. New inventory

life cycle management processes leveraged with initiatives such

as PLS, SSI, ERP implementation and the Sales and Operations

Planning process are expected to improve inventory levels in the

long-term. Inventory days are down three days in 2008 as com-

pared to 2007, and we expect our initiatives to help us deliver

improvements of three to five inventory day reductions per year

for the next three to four years.

We maintain defined benefit pension plans and unfunded sup-

plemental pension benefit plans (see Note 11, Employee Benefit

Plans). Our funding policy for these plans is based on legal

requirements and cash flows. The amounts necessary to fund

future obligations under these plans could vary depending on

estimated assumptions (as detailed in “Critical Accounting

Estimates”). The future funding for these plans will depend on

economic conditions, employee demographics, mortality rates,

the number of associates electing to take lump-sum distribu-

tions, investment performance and funding decisions. Based on

current assumptions, we expect to make contributions in the

range of $60 to $100 to our U.S. pension plans and in the range

of $20 to $30 to our international pension plans during 2009.

Net cash provided by operating activities decreased by $206.3

during 2007 as compared to 2006, primarily due to higher

payments for inventory purchases, higher incentive-based

compensation payments in 2007 for compensation earned in

2006 and higher interest payments, partially offset by lower

payments associated with restructuring initiatives.

Net Cash Used by Investing Activities

Net cash used by investing activities during 2008 was $116.2

higher than 2007, primarily due to higher capital expenditures.

2007 included a payment associated with an acquisition of a

licensee in Egypt.

Capital expenditures during 2008 were $380.5 compared with

$278.5 in 2007. This increase was primarily driven by capital

spending in 2008 for the construction of new distribution facili-

ties in North America and Latin America, and information sys-

tems (including the continued development of the ERP system).

Plant construction, expansion and modernization projects were

in progress at December 31, 2008, with an estimated cost to

complete of approximately $430. Capital expenditures in 2009

are currently expected to be in the range of $325 to $375 and

will be funded by cash from operations. These expenditures will

include investments for capacity expansion, modernization of

existing facilities, continued construction of new distribution

facilities in North America and Latin America and information

systems.

Net cash used by investing activities in 2007 was $79.3 higher

than in 2006 resulting from higher capital expenditures during

2007, and from payments associated with an acquisition of a

licensee in Egypt during 2007, partially offset by the acquisition

of the remaining minority interest in our two joint venture sub-

sidiaries in China for approximately $39 during 2006.

Capital expenditures during 2007 were $278.5 compared with

$174.8 in 2006. The increase in capital spending was primarily

driven by spending in 2007 for capacity expansion, the con-

struction of a new distribution facility in North America and

information systems (including the continued development of

the ERP system).