Avon 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

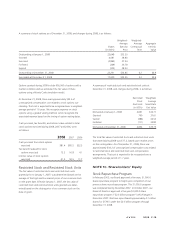

We established a grantor trust to provide assets that may be

used for the benefits payable under the SERP and SLIP and for

obligations under the DCP. The trust is irrevocable and, although

subject to creditors’ claims, assets contributed to the trust can

only be used to pay such benefits with certain exceptions. The

assets held in the trust are included in other assets and at

December 31 consisted of the following:

2008 2007

Fixed-income portfolio $16.3 $16.0

Corporate-owned life insurance

policies 40.2 37.8

Cash and cash equivalents 4.7 11.0

Total $61.2 $64.8

Additionally, we have assets that may be used for other benefit

payments. These assets are included in other assets and at

December 31 consisted of the following:

2008 2007

Corporate-owned life insurance

policies $46.3 $60.0

Mutual funds 1.4 2.5

Total $47.7 $62.5

The assets are recorded at market value, with increases or de-

creases in the corporate-owned life insurance policies reflected in

the Consolidated Statements of Income.

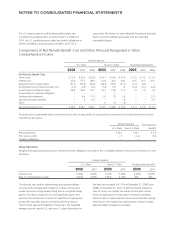

The fixed-income portfolio held in the grantor trust and the

mutual funds are classified as available-for-sale securities.

The cost, gross unrealized gains and losses and market value of

the available-for-sale securities as of December 31, were as

follows:

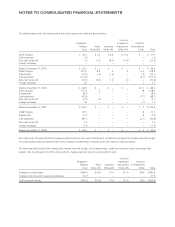

2008

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Market

Value

U.S. government bonds (1) $– $– $–$–

State and municipal

bonds(1) .6 – – .6

Mortgage backed

securities(1) .1 – – .1

Other(1) 17.5 – .5 17.0

Total available-for-sale

securities(2) $18.2 $– $.5 $17.7

(1) At December 31, 2008, investments with scheduled maturities in less

than two years totaled $.2, two to five years totaled $0, and more than

five years totaled $.6.

(2) At December 31, 2008, there were no investments with unrealized

losses in a loss position for greater than 12 months.

Payments for the purchases, proceeds and gross realized gains

and losses from the sales of these securities totaled $42.1,

$41.4, $.1 and $(.6), respectively, during 2008.

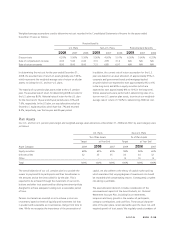

The cost, gross unrealized gains and losses and market value of

the available-for-sale securities as of December 31, were as

follows:

2007

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Market

Value

U.S. government bonds(1) $.5 $– $–$.5

State and municipal

bonds(1) 13.3 – – 13.3

Mortgage backed

securities(1) .7 – – .7

Other(1) 3.5 .5 – 4.0

Total available-for-sale

securities(2) $18.0 $.5 $– $18.5

(1) At December 31, 2007, investments with scheduled maturities in less

than two years totaled $2.0, two to five years totaled $2.5, and more

than five years totaled $10.5.

(2) At December 31, 2007, there were no investments with unrealized

losses in a loss position for greater than 12 months.

Payments for the purchases, proceeds and gross realized gains

and losses from the sales of these securities totaled $47.0,

$46.1, $.1 and $(.1), respectively, during 2007.

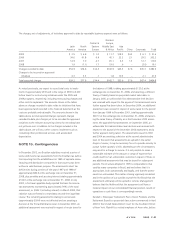

For the years ended December 31, 2008 and 2007, unrealized

gains on available-for-sale securities impacted accumulated other

comprehensive loss as follows:

2008 2007

Net unrealized gains at beginning of year,

net of taxes $ .4 $.3

Net unrealized (losses) gains, net of taxes (.7) .1

Reclassification of net gains to earnings,

net of taxes – –

Net unrealized (losses) gains end of year,

net of taxes $(.3) $.4

A V O N 2008 F-25