Avon 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Statement No. 109, (“FIN 48”). In accordance with FIN 48, we

recognize the benefit of a tax position, if that position is more

likely than not of being sustained on audit, based on the techni-

cal merits of the position.

Selling, General and Administrative

Expenses

Selling, general and administrative expenses include costs asso-

ciated with selling; marketing; and distribution activities, includ-

ing shipping and handling costs; advertising; research and

development; information technology; and other administrative

costs, including finance, legal and human resource functions.

Shipping and Handling

Shipping and handling costs are expensed as incurred and

amounted to $972.1 in 2008 (2007 - $913.9; 2006 - $810.0).

Shipping and handling costs are included in selling, general and

administrative expenses on the Consolidated Statements

of Income.

Advertising

Advertising costs, excluding brochure preparation costs, are

expensed as incurred and amounted to $390.5 in 2008 (2007 -

$368.4; 2006 - $248.9).

Research and Development

Research and development costs are expensed as incurred and

amounted to $70.0 in 2008 (2007 - $71.8; 2006 - $65.8).

Research and development costs include all costs related to the

design and development of new products such as salaries and

benefits, supplies and materials and facilities costs.

Share-based Compensation

All share-based payments to employees are recognized in the

financial statements based on their fair values using an option-

pricing model at the date of grant. We use a Black-Scholes-

Merton option-pricing model to calculate the fair value

of options.

Restructuring Reserves

We record severance-related expenses once they are both prob-

able and estimable in accordance with the provisions of State-

ment of Financial Accounting Standard (“SFAS”) No. 112,

Employer’s Accounting for Post-Employment Benefits, for sev-

erance provided under an ongoing benefit arrangement.

One-time, involuntary benefit arrangements and disposal costs,

primarily contract termination costs, are accounted for under the

provisions of SFAS No. 146, Accounting for Costs Associated

with Exit or Disposal Activities. One-time, voluntary benefit

arrangements are accounted for under the provisions of SFAS

No. 88, Employers’ Accounting for Settlements and Curtailments

of Defined Benefit Pension Plans and for Termination Benefits.

We evaluate impairment issues under the provisions of SFAS

No. 144, Accounting for the Impairment or Disposal of

Long-Lived Assets.

Contingencies

In accordance with SFAS No. 5, Accounting for Contingencies,

we determine whether to disclose and accrue for loss contin-

gencies based on an assessment of whether the risk of loss is

remote, reasonably possible or probable. We record loss contin-

gencies when it is probable that a liability has been incurred and

the amount of loss is reasonably estimable.

Reclassifications

We have reclassified some prior year amounts in the Con-

solidated Financial Statements and accompanying notes for

comparative purposes. We reclassified $45.4 from accounts

receivable to prepaid expenses and other on the Consolidated

Balance Sheet for the year ended December 31, 2007. We also

reclassified $17.9 and $8.0 from changes in accounts receivable

to changes in prepaid expenses and other on the Consolidated

Statements of Cash Flows for the years ended December 31,

2007 and 2006, respectively.

Earnings per Share

We compute basic earnings per share (“EPS”) by dividing net

income by the weighted-average number of shares outstanding

during the year. Diluted EPS is calculated to give effect to all

potentially dilutive common shares that were outstanding during

the year.

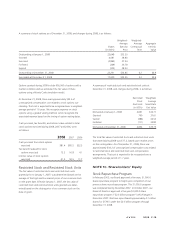

For each of the three years ended December 31, the

components of basic and diluted EPS were as follows:

(Shares in millions) 2008 2007 2006

Numerator:

Net income $ 875.3 $ 530.7 $ 477.6

Denominator:

Basic EPS weighted-average

shares outstanding 426.36 433.47 447.40

Diluted effect of assumed

conversion of share-based

awards 3.17 3.42 1.76

Diluted EPS adjusted

weighted-average shares

outstanding 429.53 436.89 449.16

Earnings Per Share:

Basic $ 2.05 $ 1.22 $ 1.07

Diluted $ 2.04 $ 1.21 $ 1.06

A V O N 2008 F-9