Avon 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

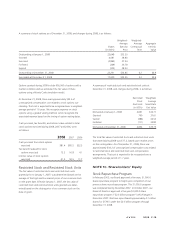

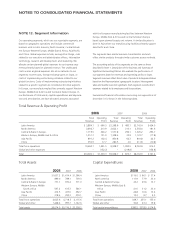

NOTE 11. Employee Benefit Plans

Savings Plan

We offer a qualified defined contribution plan for U.S.-based

employees, the Avon Personal Savings Account Plan (the “PSA”),

which allows eligible participants to contribute up to 25% of

eligible compensation through payroll deductions. We match

employee contributions dollar for dollar up to the first 3% of

eligible compensation and fifty cents for each dollar contributed

from 4% to 6% of eligible compensation. In 2008, 2007, and

2006, matching contributions approximating $13.0, $12.8 and

$12.7, respectively, were made to the PSA in cash, which were

then used by the PSA to purchase Avon shares in the open

market.

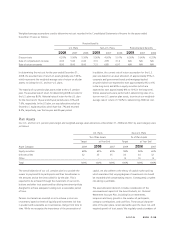

Defined Benefit Pension and

Postretirement Plans

Avon and certain subsidiaries have contributory and non-

contributory retirement plans for substantially all employees of

those subsidiaries. Benefits under these plans are generally based

on an employee’s years of service and average compensation

near retirement. Plans are funded based on legal requirements

and cash flow.

We provide health care and life insurance benefits for the

majority of employees who retire under our retirement plans in

the U.S. and certain foreign countries. In the U.S., the cost of

such health care benefits is shared by us and our retirees for

employees hired on or before January 1, 2005. Employees hired

after January 1, 2005, will pay the full cost of the health care

benefits upon retirement.

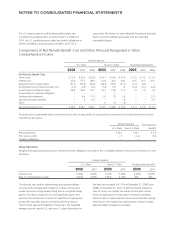

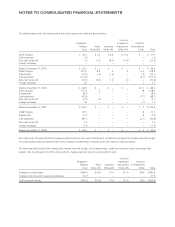

In September 2006, the FASB issued SFAS No. 158, Employers’

Accounting for Defined Benefit Pension and Other Postretire-

ment Plans - an amendment of FASB Statements No. 87, 88, 106

and 132R (“SFAS 158”). SFAS 158 requires, among other things,

the recognition of the funded status of pension and other post-

retirement benefit plans on the balance sheet. Each overfunded

plan is recognized as an asset and each underfunded plan is

recognized as a liability. The initial impact of the standard, due

to unrecognized prior service costs or credits and net actuarial

gains or losses, as well as subsequent changes in the funded

status, were recognized as components of accumulated compre-

hensive loss in shareholders’ equity. Additional minimum pen-

sion liabilities and related intangible assets were also derecog-

nized upon adoption of the new standard. The adoption of SFAS

158 resulted in a decrease to accumulated other comprehensive

loss of $254.7 after taxes at December 31, 2006. The adoption

of SFAS 158 had no impact on our Consolidated Statement of

Income for the year ended December 31, 2006. SFAS 158’s

provisions regarding the change in the measurement date of

defined benefit and other postretirement plans had no impact as

we were already using a measurement date of December 31 for

our pension plans.