Avon 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

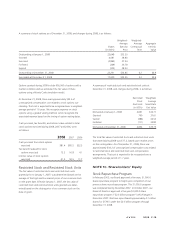

For the years ended December 31, 2008, 2007 and 2006, we did

not include stock options to purchase 21.3 million shares,

7.4 million and 12.9 million shares of Avon common stock,

respectively, in the calculations of diluted EPS because the

exercise prices of those options were greater than the average

market price and their inclusion would be anti-dilutive.

NOTE 2. New Accounting Standards

Standards Implemented

Effective January 1, 2008, we adopted Financial Accounting

Standards Board (“FASB”) SFAS 157, Fair Value Measurements

(“SFAS 157”), with the exception of the application of the

statement to non-recurring, nonfinancial assets and liabilities.

SFAS 157 defines fair value, establishes a framework for measur-

ing fair value in accordance with generally accepted accounting

principles, and expands disclosures about fair value measure-

ments. In February 2008, the FASB issued Staff Position 157-2,

Effective Date of FASB Statement No. 157, which delays the

effective date of SFAS No. 157 for nonfinancial assets and

liabilities, except for those that are recognized or disclosed at fair

value in the financial statements on a recurring basis, until

January 1, 2009. The adoption of SFAS 157 did not have a mate-

rial impact on our Consolidated Financial Statements. See Note

8, Fair Value, for additional information.

Effective January 1, 2008, we adopted SFAS No. 159, The Fair

Value Option for Financial Assets and Financial Liabilities –

including an amendment to FASB Statement No. 115, (“SFAS

159”), which permits entities to choose to measure many finan-

cial instruments and certain other items at fair value that are not

currently required to be measured at fair value. The adoption of

SFAS 159 had no impact on our Consolidated Financial State-

ments, as we did not choose to measure the items at fair value.

Effective January 1, 2007, we adopted Financial Accounting

Standards Board (“FASB”) Interpretation No. 48, Accounting for

Uncertainty in Income Taxes – an interpretation of FASB State-

ment No. 109, (“FIN 48”). See Note 6, Income Taxes, for

additional information.

Effective December 31, 2006, we adopted SFAS No. 158,

Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans – an amendment of FASB Statements

No. 87, 88, 106 and 132R (“SFAS 158”). See Note 11, Employee

Benefit Plans, for additional information.

Effective December 31, 2006, we adopted Staff Accounting

Bulletin (“SAB”) No. 108, Considering the Effects of Prior Year

Misstatements when Quantifying Misstatements in Current Year

Financial Statements (“SAB 108”), which provides interpretive

guidance on the consideration of the effects of prior year

misstatements in quantifying current year misstatements for the

purpose of a materiality assessment. SAB 108 allows for a

one-time transitional cumulative effect adjustment to beginning

retained earnings as of January 1, 2007, for errors that were not

previously deemed material, but are material under the guidance

in SAB 108. The adoption of SAB 108 had no impact on our

Consolidated Financial Statements.

Standards to be Implemented

In December 2008, the FASB issued Staff Position No. (“FSP”)

FAS 132(R)-1, Employers’ Disclosures about Postretirement Bene-

fit Plan Assets. The FSP will require additional disclosures about

the major categories of plan assets and concentrations of risk, as

well as disclosure of fair value levels, similar to the disclosure

requirements of SFAS 157. The enhanced disclosures about plan

assets required by this FSP must be provided in our 2009 Annual

Report on Form 10-K.

In February 2008, the FASB issued SFAS No. 161, Disclosures

about Derivative Instruments and Hedging Activities – an

amendment of FASB Statement No. 133, (“SFAS 161”) which

changes, among other things, the disclosure requirements for

derivative instruments and hedging activities. We will be re-

quired to provide enhanced disclosures about how and why we

use derivative instruments, how they are accounted for, and how

they affect our financial performance. SFAS 161 is effective

January 1, 2009, for Avon.

In June 2008, the FASB issued FSP Emerging Issues Task Force

(“EITF”) 03-6-1, Determining Whether Instruments Granted in

Share-Based Payment Transactions Are Participating Securities,

(“FSP EITF 03-6-1”), which addresses whether instruments grant-

ed in share-based payment awards are participating securities

prior to vesting and, therefore, need to be included in the earn-

ings allocation in computing earnings per share (“EPS”) under

the two-class method. FSP EITF 03-6-1 is effective January 1,

2009, for Avon and requires prior period EPS presented to be

adjusted retrospectively. Our grants of restricted stock and re-

stricted stock units contain non-forfeitable rights to dividend

equivalents and are considered participating securities as defined

in FSP EITF 03-6-1 and will be included in computing earnings

per share using the two-class method beginning with our first

quarter 2009 Form 10-Q. The adoption of FSP EITF 03-6-1 will

not have a material impact on the calculation of basic or diluted

earnings per share.

In December 2007, the FASB issued SFAS No. 141 (revised 2007),

Business Combinations, (“SFAS 141R”), which changes how

business combinations are accounted for and will impact financial

statements both on the acquisition date and in subsequent peri-

ods. SFAS 141R is effective January 1, 2009, for Avon and will be

applied prospectively. The impact of adopting SFAS 141R will

depend on the nature and terms of future acquisitions.