Avon 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

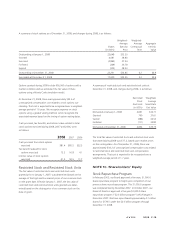

2008. In August 2008, we entered into another amendment of

our yen credit facility that provides for the extension of the yen

credit facility until August 2009. At December 31, 2008 and

2007, $102.0 (Japanese yen 9.2 billion) and $96.3 (Japanese yen

11.0 billion), respectively, was outstanding under the yen credit

facility.

The indentures under which the above notes were issued contain

certain covenants, including limits on the incurrence of liens and

restrictions on the incurrence of sale/leaseback transactions and

transactions involving a merger, consolidation or sale of sub-

stantially all of our assets. At December 31, 2008, we were in

compliance with all covenants in our indentures. Such indentures

do not contain any rating downgrade triggers that would

accelerate the maturity of our debt. However, we would be

required to make an offer to repurchase the 2013 Notes and

2018 Notes at a price equal to 101% of their aggregate principal

amount plus accrued and unpaid interest in the event of a

change in control involving Avon and a corresponding ratings

downgrade to below investment grade.

At December 31, 2008, we also had letters of credit outstanding

totaling $19.6, which primarily guarantee various insurance

activities. In addition, we had outstanding letters of credit for

various trade activities and commercial commitments executed in

the ordinary course of business, such as purchase orders for

normal replenishment of inventory levels.

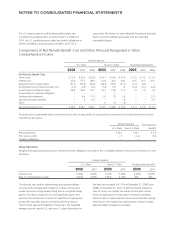

NOTE 5. Accumulated Other

Comprehensive Loss

Accumulated other comprehensive loss at December 31 con-

sisted of the following:

2008 2007

Foreign currency translation adjustments $(406.2) $ (62.5)

Unrealized (losses) gains from

available-for-sale securities, net of taxes of

$.2 and $.1 (.3) .4

Unrecognized actuarial losses, prior service

credit, and transition obligation, net of

taxes of $266.8 and $167.5 (532.2) (337.2)

Net derivative losses from cash flow hedges,

net of taxes of $14.8 and $9.7 (27.2) (17.7)

Total $(965.9) $(417.0)

Foreign exchange gains (losses) of $25.4 and ($8.1) resulting

from the translation of unrealized actuarial losses, prior service

credit and translation obligation recorded in AOCI are included

in foreign currency translation adjustments in the rollforward of

AOCI on the Consolidated Statements of Changes in Share-

holders Equity for 2008 and 2007, respectively.

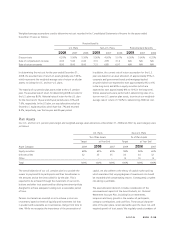

NOTE 6. Income Taxes

Deferred tax assets (liabilities) resulting from temporary differ-

ences in the recognition of income and expense for tax and

financial reporting purposes at December 31 consisted of the

following:

2008 2007

Deferred tax assets:

Postretirement benefits $ 46.9 $ 43.0

Accrued expenses and reserves 155.0 176.7

Asset revaluations 52.7 42.6

Restructuring initiatives 12.9 48.8

Employee benefit plans 261.1 197.3

Foreign operating loss carryforwards 300.9 295.8

Postemployment benefits 17.0 16.1

Capitalized expenses 46.0 18.8

Minimum tax credit carryforwards 32.5 24.9

Foreign tax credit carryforwards 93.9 28.6

All other 35.5 22.6

Valuation allowance (284.1) (278.3)

Total deferred tax assets 770.3 636.9

Deferred tax liabilities:

Depreciation and amortization (45.3) (53.9)

Prepaid retirement plan costs (6.0) (37.4)

Capitalized interest (6.1) (2.1)

Capitalized software (5.4) (6.8)

Unremitted foreign earnings (19.1) (20.1)

All other (34.6) (21.9)

Total deferred tax liabilities (116.5) (142.2)

Net deferred tax assets $ 653.8 $ 494.7

Deferred tax assets (liabilities) at December 31 were classified as

follows:

2008 2007

Deferred tax assets:

Prepaid expenses and other $194.6 $261.4

Other assets 502.5 272.9

Total deferred tax assets 697.1 534.3

Deferred tax liabilities:

Income taxes (7.0) (7.7)

Long-term income taxes (36.3) (31.9)

Total deferred tax liabilities (43.3) (39.6)

Net deferred tax assets $653.8 $494.7

The valuation allowance primarily represents amounts for foreign

operating loss carryforwards. The basis used for recognition of

deferred tax assets included the profitability of the operations,

related deferred tax liabilities and the likelihood of utilizing tax

credit carryforwards during the carryover periods. The net

A V O N 2008 F-13