Avon 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

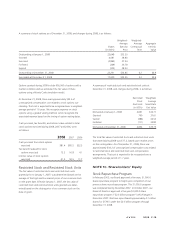

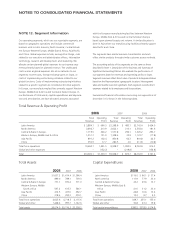

A summary of stock options as of December 31, 2008, and changes during 2008, is as follows:

Shares

(in 000’s)

Weighted-

Average

Exercise

Price

Weighted-

Average

Contractual

Term

Aggregate

Intrinsic

Value

Outstanding at January 1, 2008 22,648 $33.25

Granted 4,081 38.80

Exercised (2,895) 27.34

Forfeited (249) 36.78

Expired (324) 38.43

Outstanding at December 31, 2008 23,261 $34.85 6.2 $4.9

Exercisable at December 31, 2008 17,000 $33.55 5.2 $4.9

Options granted during 2008 include 600,000 of options with a

market condition and we estimated the fair value of these

options using a Monte-Carlo simulation model.

At December 31, 2008, there was approximately $23.6 of

unrecognized compensation cost related to stock options out-

standing. That cost is expected to be recognized over a weighted-

average period of 1.6 years. We recognize expense on stock

options using a graded vesting method, which recognizes the

associated expense based on the timing of option vesting dates.

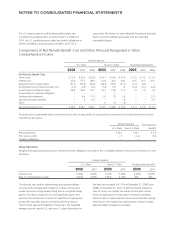

Cash proceeds, tax benefits, and intrinsic value related to total

stock options exercised during 2008, 2007 and 2006, were

as follows:

2008 2007 2006

Cash proceeds from stock options

exercised $81.4 $85.5 $32.5

Tax benefit realized for stock

options exercised 12.2 16.8 4.1

Intrinsic value of stock options

exercised 41.5 50.5 11.7

Restricted Stock and Restricted Stock Units

The fair value of restricted stock and restricted stock units

granted prior to January 1, 2007, was determined based on the

average of the high and low market prices of our common stock

on the grant date. Effective January 1, 2007, the fair value of

restricted stock and restricted stock units granted was deter-

mined based on the closing price of our common stock on the

date of grant.

A summary of restricted stock and restricted stock units at

December 31, 2008, and changes during 2008, is as follows:

Restricted

Stock

And Units

(in 000’s)

Weighted-

Average

Grant-Date

Fair Value

Nonvested at January 1, 2008 2,691 $34.71

Granted 760 37.61

Vested (486) 34.53

Forfeited (111) 34.83

Nonvested at December 31, 2008 2,854 $35.75

The total fair value of restricted stock and restricted stock units

that vested during 2008 was $17.2, based upon market prices

on the vesting dates. As of December 31, 2008, there was

approximately $34.2 of unrecognized compensation cost related

to restricted stock and restricted stock unit compensation

arrangements. That cost is expected to be recognized over a

weighted-average period of 1.7 years.

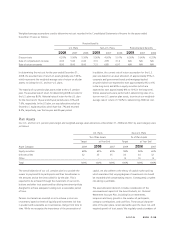

NOTE 10. Shareholders’ Equity

Stock Repurchase Program

In February 2005, our Board approved a five-year, $1,000.0

share repurchase program to begin upon completion of our

previous share repurchase program. This $1,000.0 program

was completed during December 2007. In October 2007, our

Board of Directors approved a five-year $2,000.0 share

repurchase program (“$2.0 billion program”) which began in

December 2007. We have repurchased approximately 4.7 million

shares for $178.5 under the $2.0 billion program through

December 31, 2008.

A V O N 2008 F-19