3M 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

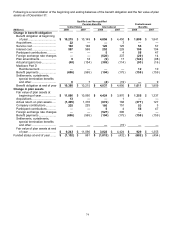

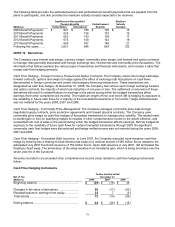

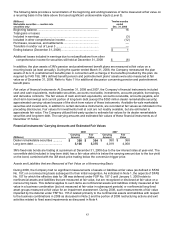

The following table provides a reconciliation of the beginning and ending balances of items measured at fair value on

a recurring basis in the table above that used significant unobservable inputs (Level 3).

(Millions)

Marketable securities — auction rate

securities only

Twelve months

ended

Dec. 31, 2008

Beginning balance.............................................................................. $ 16

Total gains or losses:

Included in earnings ........................................................................... (3 )

Included in other comprehensive income .......................................... (12 )

Purchases, issuances, and settlements............................................. —

Transfers in and/or out of Level 3 ...................................................... —

Ending balance (December 31, 2008) ............................................... $ 1

Additional losses included in earnings due to reclassifications from other

comprehensive income for securities still held at December 31, 2008 $ (6 )

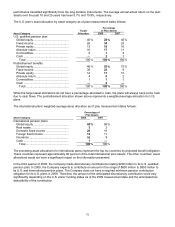

In addition, the plan assets of 3M’s pension and postretirement benefit plans are measured at fair value on a

recurring basis (at least annually). During the quarter ended March 31, 2008, the Company remeasured the plan

assets of its U.S. postretirement benefits plan in connection with a change in the benefits provided by this plan. As

required by FAS 158, 3M’s defined benefit pension and postretirement plans’ assets were also measured at fair

value as of December 31, 2008. Refer to Note 11 for additional discussion concerning pension and postretirement

benefit plans.

Fair value of financial instruments: At December 31, 2008 and 2007, the Company’s financial instruments included

cash and cash equivalents, marketable securities, accounts receivable, investments, accounts payable, borrowings,

and derivative contracts. The fair values of cash and cash equivalents, accounts receivable, accounts payable, and

short-term borrowings and current portion of long-term debt (except the $350 million dealer remarketable security)

approximated carrying values because of the short-term nature of these instruments. Available-for-sale marketable

securities and investments, in addition to certain derivative instruments, are recorded at fair values as indicated in the

preceding disclosures. Fair values for investments held at cost are not readily available, but are estimated to

approximate fair value. The Company utilized third-party quotes to estimate fair values for its dealer remarketable

securities and long-term debt. The carrying amounts and estimated fair values of these financial instruments as of

December 31 follow:

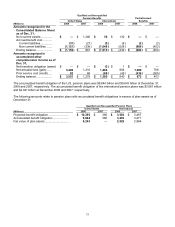

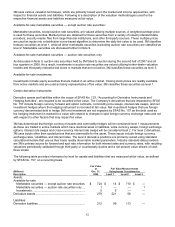

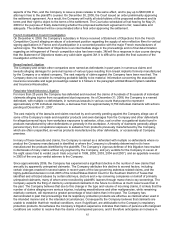

Financial Instruments’ Carrying Amounts and Estimated Fair Values

2008 2007

(Millions)

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Dealer remarketable securities ............ $ 350 $ 364 $ 350 $ 368

Long-term debt ..................................... 5,166 5,375 4,019 4,008

3M’s fixed-rate bonds are trading at a premium at December 31, 2008 due to the low interest rates at year-end. The

convertible debt (included in long-term debt) has a fair value which is below the carrying amount due to the low yield

on the bond, combined with the 3M stock price trading below the conversion trigger price.

Assets and Liabilities that are Measured at Fair Value on a Nonrecurring Basis:

During 2008, the Company had no significant measurements of assets or liabilities at fair value (as defined in SFAS

No. 157) on a nonrecurring basis subsequent to their initial recognition. As indicated in Note 1, the aspects of SFAS

No. 157 for which the effective date for 3M was deferred under FSP No. 157-2 until January 1, 2009 relate to

nonfinancial assets and liabilities that are measured at fair value, but are recognized or disclosed at fair value on a

nonrecurring basis. This deferral applies to such items as nonfinancial assets and liabilities initially measured at fair

value in a business combination (but not measured at fair value in subsequent periods) or nonfinancial long-lived

asset groups measured at fair value for an impairment assessment. During 2008, such measurements of fair value

impacted by the deferral under FSP No. 157-2 related primarily to the nonfinancial assets and liabilities with respect

to the business combinations in 2008 as discussed in Note 2 and the portion of 2008 restructuring actions and exit

activities related to fixed asset impairments as discussed in Note 4.