3M 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

As discussed in Note 11, the Company does not have a required minimum pension contribution obligation for its U.S.

plans in 2009 and Company contributions to its U.S. and international pension plans are expected to be largely

discretionary in 2009 and future years; therefore, amounts related to these plans are not included in the preceding

table.

FINANCIAL INSTRUMENTS

The Company enters into contractual derivative arrangements in the ordinary course of business to manage foreign

currency exposure, interest rate risks and commodity price risks. A financial risk management committee, composed

of senior management, provides oversight for risk management and derivative activities. This committee determines

the Company’s financial risk policies and objectives, and provides guidelines for derivative instrument utilization. This

committee also establishes procedures for control and valuation, risk analysis, counterparty credit approval, and

ongoing monitoring and reporting.

The Company enters into foreign exchange forward contracts, options and swaps to hedge against the effect of

exchange rate fluctuations on cash flows denominated in foreign currencies and certain intercompany financing

transactions. The Company manages interest rate risks using a mix of fixed and floating rate debt. To help manage

borrowing costs, the Company may enter into interest rate swaps. Under these arrangements, the Company agrees

to exchange, at specified intervals, the difference between fixed and floating interest amounts calculated by

reference to an agreed-upon notional principal amount. The Company manages commodity price risks through

negotiated supply contracts, price protection agreements and forward physical contracts.

A Monte Carlo simulation technique was used to test the Company’s exposure to changes in currency and interest

rates and assess the risk of loss or benefit in after-tax earnings of financial instruments, derivatives and underlying

exposures outstanding at December 31, 2008. The model (third-party bank dataset) used a 95 percent confidence

level over a 12-month time horizon. The model used analyzed 17 currencies, interest rates related to three

currencies, and five commodities, but does not purport to represent what actually will be experienced by the

Company. This model does not include certain hedge transactions, because the Company believes their inclusion

would not materially impact the results. Foreign exchange rate risk of loss or benefit increased substantially in 2008

primarily due to increases in volatility during 2008, which is one of the key drivers in the valuation model. The decline

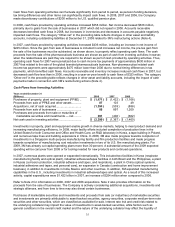

in interest rate risk of loss or benefit during 2008 was primarily due to decreases in interest rates. The following table

summarizes the possible adverse and positive impacts to after-tax earnings related to these exposures.

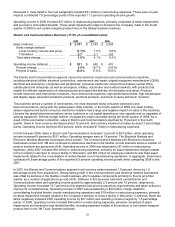

Adverse impact on Positive impact on

after-tax earnings after-tax earnings

(Millions) 2008 2007 2008 2007

Foreign exchange rates ... $ (108 ) $ (54 ) $ 131 $57

Interest rates .................... (5 ) (13 ) 5 15

Commodity rates .............. (3 ) (3 ) — 2

The global exposures related to purchased components and materials are such that a 1 percent price change would

result in a pre-tax cost or savings of approximately $63 million per year. The global energy exposure is such that a 10

percent price change would result in a pre-tax cost or savings of approximately $42 million per year. Derivative

instruments are used to hedge approximately 1 percent of the purchased components and materials exposure and

are used to hedge approximately 10 percent of this energy exposure.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K including “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in Item 7, contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. The Company may also make forward-looking statements in other reports filed with

the Securities and Exchange Commission, in materials delivered to stockholders and in press releases. In addition,

the Company’s representatives may from time to time make oral forward-looking statements.

Forward-looking statements relate to future events and typically address the Company’s expected future business

and financial performance. Words such as “plan,” “expect,” “aim,” “believe,” “project,” “target,” “anticipate,” “intend,”

“estimate,” “will,” “should,” “could” and other words and terms of similar meaning, typically identify such forward-

looking statements. In particular, these include statements about the Company’s strategy for growth, product

development, market position, future performance or results of current or anticipated products, interest rates, foreign

exchange rates, financial results, and the outcome of contingencies, such as legal proceedings. The Company

assumes no obligation to update or revise any forward-looking statements.

Forward-looking statements are based on certain assumptions and expectations of future events and trends that are

subject to risks and uncertainties. Actual future results and trends may differ materially from historical results or those