3M 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

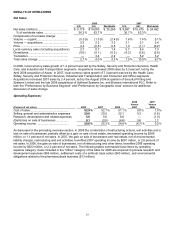

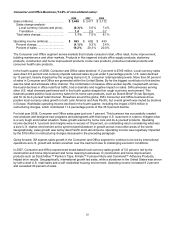

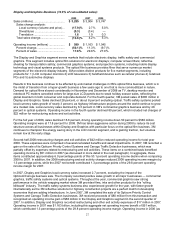

Consumer and Office Business (13.6% of consolidated sales):

2008 2007 2006

Sales (millions)....................................... $ 3,448 $ 3,411 $ 3,172

Sales change analysis:

Local currency (volume and price).. (0.3 )% 5.0 % 7.4 %

Translation ...................................... 1.4 2.5 0.7

Total sales change.............................. 1.1 % 7.5 % 8.1 %

Operating income (millions) ................... $ 663 $ 692 $ 633

Percent change................................... (4.1 )% 9.2 % 3.4 %

Percent of sales .................................. 19.2 % 20.3 % 20.0 %

The Consumer and Office segment serves markets that include consumer retail, office retail, home improvement,

building maintenance and other markets. Products in this segment include office supply products, stationery

products, construction and home improvement products, home care products, protective material products and

consumer health care products.

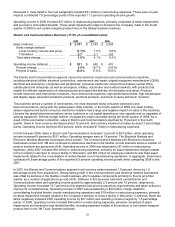

In the fourth quarter of 2008, Consumer and Office sales declined 11.2 percent to $765 million. Local currency sales

were down 6.5 percent and currency impacts reduced sales by just under 5 percentage points. U.S. sales declined

by 13 percent, heavily impacted by the ongoing slump in U.S. consumer retail spending levels. More than 50 percent

of sales in Consumer and Office are generated within the United States. By far the biggest contributor to this decline

was the retail and wholesale office channel. The combination of massive office worker layoffs, coupled with across-

the-board declines in office retail foot traffic, had a dramatic and negative impact on sales. 3M businesses serving

other U.S. retail channels performed well in the fourth quarter despite this rough economic environment. This

business posted positive local-currency sales for its home care products, such as Scotch-Brite®Scrub Sponges,

and for its do-it-yourself retail channel. Elsewhere around the globe, 3M’s Consumer and Office business drove

positive local-currency sales growth in both Latin America and Asia Pacific, but overall growth was muted by declines

in Europe. Worldwide operating income declined in the fourth quarter, including the impact of $18 million in

restructuring charges, which contributed 11.4 percentage points of this 35.5 percent decline.

For total year 2008, Consumer and Office sales grew just over 1 percent. This business has successfully created

new products and designed new programs and planograms with their large U.S. customers in order to mitigate what

is a very tough end-market situation. Sales growth was led by home care and do-it-yourself products. Operating

income declined 4.1 percent and margins were in excess of 19 percent, an outstanding return considering what was

a slow U.S. market environment and a synchronized slowdown in growth across most other areas of the world.

Geographically, sales growth was led by Asia Pacific and Latin America. Operating income was negatively impacted

by the $18 million in restructuring charges discussed in the preceding paragraph.

Going forward, 3M expects sales growth in the Consumer and Office segment to continue to be led by international

operations as U.S. growth will remain uncertain over the near term due to challenging economic conditions.

In 2007, Consumer and Office experienced broad-based local-currency sales growth of 5.0 percent, led by the

construction and home improvement and home cleaning businesses. In construction and home improvement,

products such as Scotch-Blue™ Painter’s Tape, Filtrete™ Furnace Filters and Command™ Products,

helped drive results. Geographically, international growth led sales, while a slowdown in the United States was driven

by soft overall U.S. retail sales and a soft residential housing environment. Operating income increased 9.2 percent

and exceeded 20 percent of sales.

Adhesive