3M 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

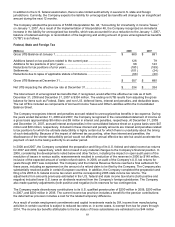

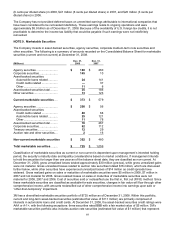

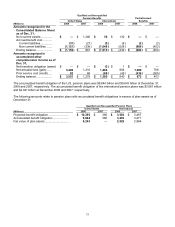

interests in investment grade credit default swaps. During the second half of 2007 and all four quarters in 2008, these

auction rate securities failed to auction due to sell orders exceeding buy orders. Liquidity for these auction-rate

securities is typically provided by an auction process that resets the applicable interest rate at pre-determined

intervals, usually every 7, 28, 35, or 90 days. The funds associated with failed auctions will not be accessible until a

successful auction occurs or a buyer is found outside of the auction process. Based upon an analysis of “temporary”

and “other-than-temporary” impairment factors, auction rate securities with an original par value of approximately $34

million were written-down to an estimated fair value of $16 million as of December 31, 2007 and subsequently

written-down to an estimated fair value of $1 million as of December 31, 2008. 3M recorded “other-than-temporary”

impairment charges that reduced pre-tax income by approximately $8 million in 2007 and approximately $9 million in

2008. There are $16 million (pre-tax) of temporary impairments at December 31, 2008, which were recorded as

unrealized losses within other comprehensive income. As of December 31, 2008, these investments in auction rate

securities have been in a loss position for approximately 15 months. These auction rate securities are classified as

non-current marketable securities as of December 31, 2008 as indicated in the preceding table. Refer to Note 13 for

a table that reconciles the beginning and ending balances of auction rate securities for 2008.

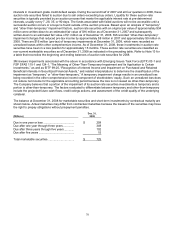

3M reviews impairments associated with the above in accordance with Emerging Issues Task Force (EITF) 03-1 and

FSP SFAS 115-1 and 124-1, “The Meaning of Other-Than-Temporary-Impairment and Its Application to Certain

Investments,” as well as EITF 99-20, “Recognition of Interest Income and Impairment on Purchased and Retained

Beneficial Interests in Securitized Financial Assets,” and related interpretations to determine the classification of the

impairment as “temporary” or “other-than-temporary.” A temporary impairment charge results in an unrealized loss

being recorded in the other comprehensive income component of stockholders’ equity. Such an unrealized loss does

not reduce net income for the applicable accounting period because the loss is not viewed as other-than-temporary.

The Company believes that a portion of the impairment of its auction rate securities investments is temporary and a

portion is other-than-temporary. The factors evaluated to differentiate between temporary and other-than-temporary

include the projected future cash flows, credit ratings actions, and assessment of the credit quality of the underlying

collateral.

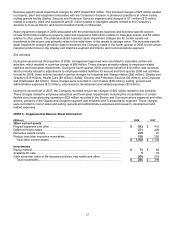

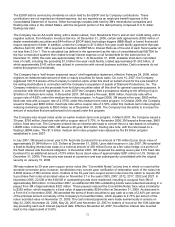

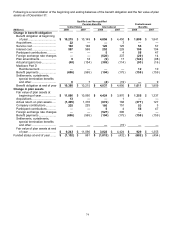

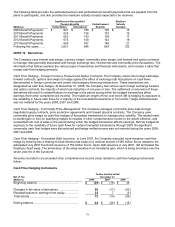

The balance at December 31, 2008 for marketable securities and short-term investments by contractual maturity are

shown below. Actual maturities may differ from contractual maturities because the issuers of the securities may have

the right to prepay obligations without prepayment penalties.

Dec. 31,

(Millions) 2008

Due in one year or less ....................................... $ 259

Due after one year through three years .............. 349

Due after three years through five years............. 102

Due after five years ............................................. 15

Total marketable securities ................................. $ 725