3M 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

collaborative arrangement) should be reported by the collaborators on the respective line items in their income

statements pursuant to EITF Issue No. 99-19, “Reporting Revenue Gross as a Principal Versus Net as an Agent.”

Additionally, the consensus provides that income statement characterization of payments between the participants in

a collaborative arrangement should be based upon existing authoritative pronouncements; analogy to such

pronouncements if not within their scope; or a reasonable, rational, and consistently applied accounting policy

election. EITF Issue No. 07-1 is effective for 3M beginning January 1, 2009 and is to be applied retrospectively to all

periods presented for collaborative arrangements existing as of the date of adoption. The Company does not expect

EITF Issue No. 07-1 to have a material impact on 3M’s consolidated results of operations or financial condition.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities,”

which will require increased disclosures about an entity’s strategies and objectives for using derivative instruments;

the location and amounts of derivative instruments in an entity’s financial statements; how derivative instruments and

related hedged items are accounted for under SFAS No. 133, “Accounting for Derivative Instruments and Hedging

Activities;” and how derivative instruments and related hedged items affect its financial position, financial

performance, and cash flows. Certain disclosures will also be required with respect to derivative features that are

credit-risk-related. SFAS No. 161 is effective for 3M beginning January 1, 2009 on a prospective basis. Since this

standard impacts disclosures only, the adoption will not have a material impact on 3M’s consolidated results of

operations or financial condition.

In April 2008, the FASB issued FSP No. FAS 142-3, “Determination of the Useful Life of Intangible Assets,” which

amends the list of factors an entity should consider in developing renewal or extension assumptions used in

determining the useful life of recognized intangible assets under SFAS No. 142, “Goodwill and Other Intangible

Assets.” The new guidance applies to (1) intangible assets that are acquired individually or with a group of other

assets and (2) intangible assets acquired in both business combinations and asset acquisitions. Under FSP No. FAS

142-3, entities estimating the useful life of a recognized intangible asset must consider their historical experience in

renewing or extending similar arrangements or, in the absence of historical experience, must consider assumptions

that market participants would use about renewal or extension. For 3M, this FSP will require certain additional

disclosures beginning January 1, 2009 and application to useful life estimates prospectively for intangible assets

acquired after December 31, 2008. The Company does not expect this standard to have a material impact on 3M’s

consolidated results of operations or financial condition.

In May 2008, the FASB issued FSP No. APB 14-1, “Accounting for Convertible Debt Instruments That May Be

Settled in Cash Upon Conversion (Including Partial Cash Settlement).” This FSP applies to convertible debt

securities that, upon conversion by the holder, may be settled by the issuer fully or partially in cash (rather than

settled fully in shares) and specifies that issuers of such instruments should separately account for the liability and

equity components in a manner that reflects the issuer’s nonconvertible debt borrowing rate when related interest

cost is recognized. This FSP is effective for 3M beginning January 1, 2009 with retrospective application to all

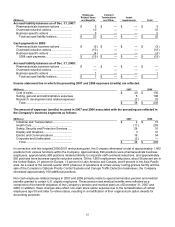

periods presented. This standard impacts the Company’s “Convertible Notes” (refer to Note 10 for more detail), and

will require that additional interest expense essentially equivalent to the portion of issuance proceeds be retroactively

allocated to the instrument’s equity component and be recognized over the period from the Convertible Notes’

issuance on November 15, 2002 through November 15, 2005 (the first date holders of these Notes had the ability to

put them back to 3M). 3M has evaluated the impact of this standard and anticipates that its retrospective application

will have no impact on results of operations for periods following 2005, but on post-2005 consolidated balance sheets

this will result in an increase of approximately $22 million in opening additional paid in capital and a corresponding

decrease in opening retained earnings.

In November 2008, the FASB ratified the Emerging Issues Task Force (EITF) consensus on Issue No. 08-6, “Equity

Method Investment Accounting Considerations” (EITF 08-6) which addresses certain effects of SFAS Nos. 141R and

160 on an entity’s accounting for equity-method investments. The consensus indicates, among other things, that

transaction costs for an investment should be included in the cost of the equity-method investment (and not

expensed) and shares subsequently issued by the equity-method investee that reduce the investor’s ownership

percentage should be accounted for as if the investor had sold a proportionate share of its investment, with gains or

losses recorded through earnings. For 3M, EITF 08-6 is effective for transactions occurring after December 31, 2008.

The Company does not expect this standard to have a material impact on 3M’s consolidated results of operations or

financial condition.

In November 2008, the FASB ratified the EITF consensus on Issue No. 08-7, “Accounting for Defensive Intangible

Assets” (EITF 08-7). The consensus addresses the accounting for an intangible asset acquired in a business

combination or asset acquisition that an entity does not intend to use or intends to hold to prevent others from

obtaining access (a defensive intangible asset). Under EITF 08-7, a defensive intangible asset would need to be

accounted as a separate unit of accounting and would be assigned a useful life based on the period over which the