3M 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

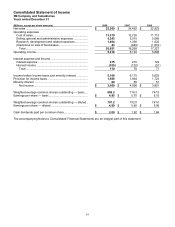

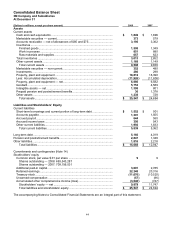

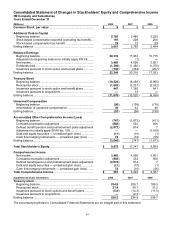

Notes to Consolidated Financial Statements

NOTE 1. Significant Accounting Policies

Consolidation: 3M is a diversified global manufacturer, technology innovator and marketer of a wide variety of

products. All significant subsidiaries are consolidated. All significant intercompany transactions are eliminated. As

used herein, the term “3M” or “Company” refers to 3M Company and subsidiaries unless the context indicates

otherwise.

Foreign currency translation: Local currencies generally are considered the functional currencies outside the United

States. Assets and liabilities for operations in local-currency environments are translated at year-end exchange rates.

Income and expense items are translated at average rates of exchange prevailing during the year. Cumulative

translation adjustments are recorded as a component of accumulated other comprehensive income (loss) in

stockholders’ equity.

Reclassifications: Certain amounts in the prior years’ consolidated financial statements have been reclassified to

conform to the current year presentation.

Use of estimates: The preparation of financial statements in conformity with U.S. generally accepted accounting

principles requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from these

estimates.

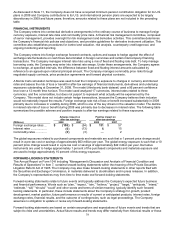

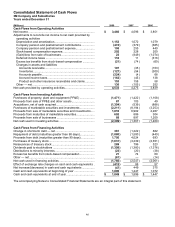

Cash and cash equivalents: Cash and cash equivalents consist of cash and temporary investments with maturities of

three months or less when purchased.

Investments: Investments primarily include the cash surrender value of life insurance policies, equity and cost method

investments, and real estate not used in the business. Investments in life insurance are reported at the amount that

could be realized under contract at the balance sheet date, with any changes in cash surrender value or contract

value during the period accounted for as an adjustment of premiums paid. Available-for-sale investments are

recorded at fair value. Unrealized gains and losses relating to investments classified as available-for-sale are

recorded as a component of accumulated other comprehensive income (loss) in stockholders’ equity.

Inventories: Inventories are stated at the lower of cost or market, with cost generally determined on a first-in, first-out

basis.

Property, plant and equipment: Property, plant and equipment, including capitalized interest and internal engineering

costs, are recorded at cost. Depreciation of property, plant and equipment generally is computed using the straight-

line method based on the estimated useful lives of the assets. The estimated useful lives of buildings and

improvements primarily range from 10 to 40 years, with the majority in the range of 20 to 40 years. The estimated

useful lives of machinery and equipment primarily range from three to 15 years, with the majority in the range of five

to 10 years. Fully depreciated assets are retained in property and accumulated depreciation accounts until disposal.

Upon disposal, assets and related accumulated depreciation are removed from the accounts and the net amount,

less proceeds from disposal, is charged or credited to operations. Property, plant and equipment amounts are

reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset

(asset group) may not be recoverable. An impairment loss would be recognized when the carrying amount of an

asset exceeds the estimated undiscounted future cash flows expected to result from the use of the asset and its

eventual disposition. The amount of the impairment loss to be recorded is calculated by the excess of the asset’s

carrying value over its fair value. Fair value is generally determined using a discounted cash flow analysis.

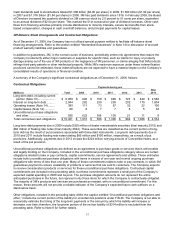

Conditional asset retirement obligations: Under Financial Accounting Standards Board (FASB) Interpretation No. 47,

“Accounting for Conditional Asset Retirement Obligations” (FIN 47), a liability is initially recorded at fair value for an

asset retirement obligation associated with the retirement of tangible long-lived assets in the period in which it is

incurred if a reasonable estimate of fair value can be made. Conditional asset retirement obligations exist for certain

of the Company’s long-term assets. The obligation is initially measured at fair value using expected present value

techniques. Over time the liabilities are accreted for the change in their present value and the initial capitalized costs

are depreciated over the useful lives of the related assets. FIN 47 was effective December 31, 2005, and its adoption

resulted in the recognition of an asset retirement obligation liability of $59 million at December 31, 2005, and an after-

tax charge of $35 million for 2005, which was reflected as a cumulative effect of change in accounting principle in the

Consolidated Statement of Income. The asset retirement obligation liability was $62 million and $59 million,

respectively, at December 31, 2008 and 2007.