3M 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

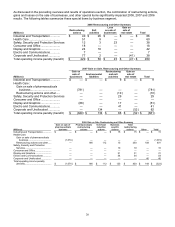

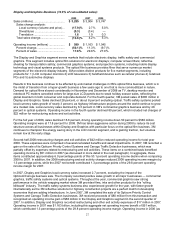

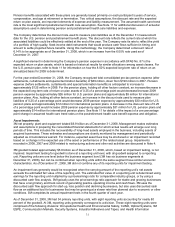

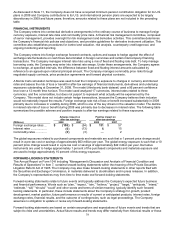

Geographic Area Supplemental Information

(Millions, except Employees as of Capital Property, Plant and

Employees) December 31, Spending Equipment — net

2008 2007 2006 2008 2007 2006 2008 2007 2006

United States............. 33,662

34,138 34,553 $ 780 $ 841 $ 692 $ 3,901

$ 3,668 $ 3,382

Asia Pacific................ 13,960

12,970 12,487 338 299 252 1,304

1,116 959

Europe, Middle East

and Africa............... 19,185

17,675 17,416 253 203 134

1,263

1,308 1,162

Latin America and

Canada .................. 12,376

11,456 10,877 100 79 90 418

490 404

Total Company .......... 79,183

76,239 75,333 $ 1,471 $ 1,422 $ 1,168 $ 6,886

$ 6,582 $ 5,907

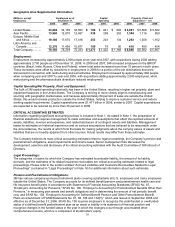

Employment:

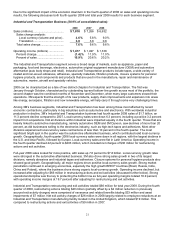

Employment increased by approximately 2,900 people since year-end 2007, with acquisitions during 2008 adding

approximately 3,700 people as of December 31, 2008. In 2008 and 2007, 3M increased employees in the BRICP

countries (Brazil, India, Russia, China and Poland), where total sales increased more than 15 percent in both years.

These increases were offset by reductions in employment in 2008 for a portion of the job eliminations that were

announced in connection with restructuring and exit activities. Employment increased by approximately 900 people

when comparing year-end 2007 to year-end 2006, with acquisitions adding approximately 2,500 employees, while

restructuring and the pharmaceuticals divestiture reduced employment.

Capital Spending/Net Property, Plant and Equipment:

The bulk of 3M capital spending historically has been in the United States, resulting in higher net property, plant and

equipment balances in the United States. The Company is striving to more closely align its manufacturing and

sourcing with geographic market sales, and because approximately 64 percent of sales are outside the United

States, this would increase production outside the United States, helping to improve customer service and reduce

working capital requirements. Capital expenditures were $1.471 billion in 2008, similar to 2007. Capital expenditures

are expected to be reduced by more than 30 percent in 2009.

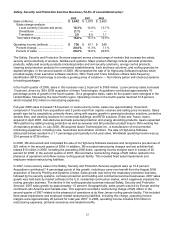

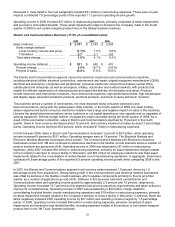

CRITICAL ACCOUNTING ESTIMATES

Information regarding significant accounting policies is included in Note 1. As stated in Note 1, the preparation of

financial statements requires management to make estimates and assumptions that affect the reported amounts of

assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. Management

bases its estimates on historical experience and on various assumptions that are believed to be reasonable under

the circumstances, the results of which form the basis for making judgments about the carrying values of assets and

liabilities that are not readily apparent from other sources. Actual results may differ from these estimates.

The Company believes its most critical accounting estimates relate to legal proceedings, the Company’s pension and

postretirement obligations, asset impairments and income taxes. Senior management has discussed the

development, selection and disclosure of its critical accounting estimates with the Audit Committee of 3M’s Board of

Directors.

Legal Proceedings:

The categories of claims for which the Company has estimated its probable liability, the amount of its liability

accruals, and the estimates of its related insurance receivables are critical accounting estimates related to legal

proceedings. Please refer to the section entitled “Accrued Liabilities and Insurance Receivables Related to Legal

Proceedings” (contained in “Legal Proceedings” in Note 14) for additional information about such estimates.

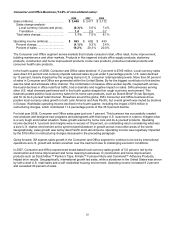

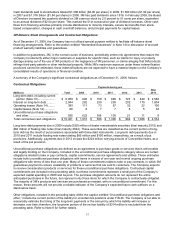

Pension and Postretirement Obligations:

3M has various company-sponsored retirement plans covering substantially all U.S. employees and many employees

outside the United States. The Company accounts for its defined benefit pension and postretirement health care and

life insurance benefit plans in accordance with Statement of Financial Accounting Standards (SFAS) No. 87,

“Employers’ Accounting for Pensions,” SFAS No. 106, “Employer’s Accounting for Postretirement Benefits Other than

Pensions,” in measuring plan assets and benefit obligations and in determining the amount of net periodic benefit

cost, and SFAS No. 158, “Employer’s Accounting for Defined Benefit Pension and Other Postretirement Benefit

Plans an amendment of FASB Statements No. 87, 88, 106 and 132(R),” which was issued in September 2006 and

effective as of December 31, 2006. SFAS No. 158 requires employers to recognize the underfunded or overfunded

status of a defined benefit postretirement plan as an asset or liability in its statement of financial position and

recognize changes in the funded status in the year in which the changes occur through accumulated other

comprehensive income, which is a component of stockholders’ equity.