3M 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

discussed in more detail in the next paragraph) included $31 million in restructuring expenses. These year-on-year

impacts contributed 7.9 percentage points of the reported 11.3 percent operating income growth.

Operating income in 2006 included $31 million in restructuring expenses, primarily comprised of asset impairments

and severance and related benefits. These asset impairments relate to decisions the Company made in the fourth

quarter of 2006 to exit certain marginal product lines in the Optical Systems business.

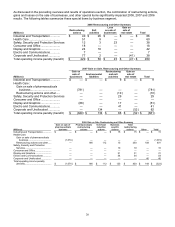

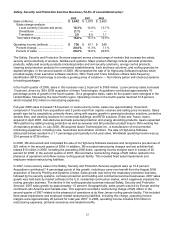

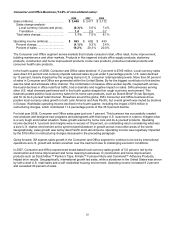

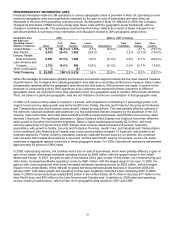

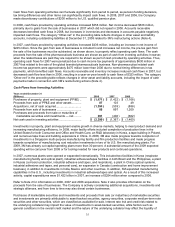

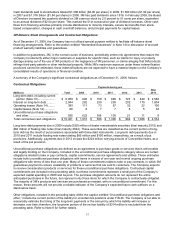

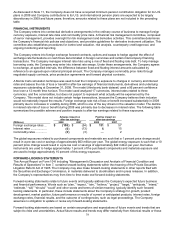

Electro and Communications Business (11.0% of consolidated sales):

2008 2007 2006

Sales (millions)........................................ $ 2,791 $ 2,763 $ 2,654

Sales change analysis:

Local currency (volume and price)... (1.7 )% 1.0 % 5.5 %

Translation ....................................... 2.7 3.1 0.8

Total sales change............................... 1.0 % 4.1 % 6.3 %

Operating income (millions) .................... $ 531 $ 492 $ 410

Percent change.................................... 8.0 % 19.7 % (0.6 )%

Percent of sales ................................... 19.0 % 17.8 % 15.5 %

The Electro and Communications segment serves the electrical, electronics and communications industries,

including electrical utilities; electrical construction, maintenance and repair; original equipment manufacturer (OEM)

electrical and electronics; computers and peripherals; consumer electronics; telecommunications central office,

outside plant and enterprise; as well as aerospace, military, automotive and medical markets; with products that

enable the efficient transmission of electrical power and speed the delivery of information and ideas. Products

include electronic and interconnect solutions, micro interconnect systems, high-performance fluids, high-temperature

and display tapes, telecommunications products, electrical products, and touch screens and touch monitors.

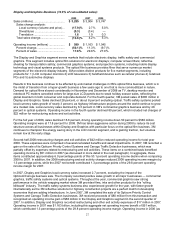

This business serves a number of end-markets, the most important being consumer electronics and

telecommunications, along with the global power utility industry. In the fourth quarter of 2008, the weak holiday

season experienced by the consumer electronics retailers had a large and negative impact on sales in this business.

Likewise the global telecommunications sector continues to cut capital spending on new capacity and on upgrades of

existing equipment. 3M had a large number of equipment orders cancelled during the fourth quarter of 2008. As a

result of this end-market contraction, sales in Electro and Communications declined by 15 percent in the fourth

quarter. Sales in local currency decreased about 12 percent, and currency impacts hurt sales by about 3 percentage

points. Operating income declined 38.8 percent, which included $7 million in restructuring expenses.

For the full-year 2008, sales in Electro and Communications increased 1 percent to $2.8 billion, while operating

income increased 8 percent to $531 million. Operating margins were at 19 percent. The Electrical Markets and

Electronic Markets Materials businesses drove growth. The Communications Markets and Electronics Solutions

businesses remain soft. 3M also continued to experience declines in the flexible circuits business where a number of

product solutions are going end-of-life. Operating income in 2008 was impacted by $7 million in restructuring

expenses, while 2007 included $18 million in restructuring expenses, primarily for asset impairment charges related

to the Company’s decision to close a facility in Wisconsin, and $23 million for employee reductions and fixed asset

impairments related to the consolidation of certain flexible circuit manufacturing operations. In aggregate, these items

contributed 6.9 percentage points of the reported 8.0 percent operating income growth when comparing 2008 to the

2007.

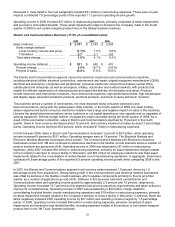

In 2007, the Electro and Communications segment local-currency sales increased 1.0 percent, driven by 1.5

percentage points from acquisitions. Strong sales growth in the communications and electrical markets businesses

was offset by declines in the flexible circuits business, which supplies components primarily to the ink jet printer

market, as a number of applications go end-of-life. Softness in this business held back overall Electro and

Communications sales and operating income growth by approximately 2.5 percent and 10 percent, respectively.

Operating income increased 19.7 percent as this segment has driven productivity improvements and taken actions to

improve its competitiveness. Operating income in 2007 was penalized by a $23 million charge related to

consolidating its global flexible circuits manufacturing operations and $18 million in restructuring expenses, primarily

for asset impairment charges related to the Company’s decision to close a facility in Wisconsin. Combined, these two

items negatively impacted 2007 operating income by $41 million and operating income margins by 1.5 percentage

points. In 2006, operating income included $54 million in restructuring expenses, primarily comprised of asset

impairments and severance and related benefits, including expenses related to the decision to exit certain marginal

product lines in the 3M Touch Systems business.