3M 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

3M uses various valuation techniques, which are primarily based upon the market and income approaches, with

respect to financial assets and liabilities. Following is a description of the valuation methodologies used for the

respective financial assets and liabilities measured at fair value.

Available-for-sale marketable securities — except auction rate securities:

Marketable securities, except auction rate securities, are valued utilizing multiple sources. A weighted average price

is used for these securities. Market prices are obtained for these securities from a variety of industry standard data

providers, security master files from large financial institutions, and other third-party sources. These multiple prices

are used as inputs into a distribution-curve-based algorithm to determine the daily fair value to be used. 3M classifies

treasury securities as level 1, while all other marketable securities (excluding auction rate securities) are classified as

level 2. Marketable securities are discussed further in Note 9.

Available-for-sale marketable securities — auction rate securities only:

As discussed in Note 9, auction rate securities held by 3M failed to auction during the second half of 2007 and all

four quarters in 2008. As a result, investments in auction rate securities are valued utilizing broker-dealer valuation

models and third-party indicative bid levels in markets that are not active. 3M classifies these securities as level 3.

Available-for-sale investments:

Investments include equity securities that are traded in an active market. Closing stock prices are readily available

from active markets and are used as being representative of fair value. 3M classifies these securities as level 1.

Certain derivative instruments:

Derivative assets and liabilities within the scope of SFAS No. 133, “Accounting for Derivative Instruments and

Hedging Activities”, are required to be recorded at fair value. The Company’s derivatives that are impacted by SFAS

No. 157 include foreign currency forward and option contracts, commodity price swaps, interest rate swaps, and net

investment hedges where the hedging instrument is recorded at fair value. Net investment hedges that use foreign

currency denominated debt to hedge 3M’s net investment are not impacted by SFAS No. 157 as the debt used as

the hedging instrument is marked to a value with respect to changes in spot foreign currency exchange rates and not

with respect to other factors that may impact fair value.

3M has determined that foreign currency forwards and commodity hedges will be considered level 1 measurements

as these are traded in active markets which have identical asset or liabilities, while currency swaps, foreign exchange

options, interest rate swaps and cross-currency interest rate swaps will be considered level 2. For level 2 derivatives,

3M uses inputs other than quoted prices that are observable for the asset. These inputs include foreign currency

exchange rates, volatilities, and interest rates. The level 2 derivative positions are primarily valued using standard

calculations/models that use as their basis readily observable market parameters. Industry standard data providers

are 3M’s primary source for forward and spot rate information for both interest rates and currency rates, with resulting

valuations periodically validated through third-party or counterparty quotes and a net present value stream of cash

flows model.

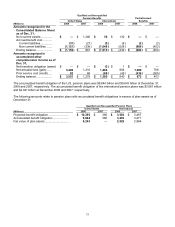

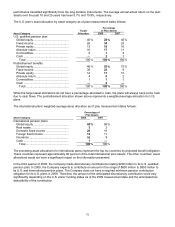

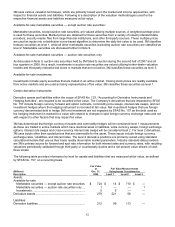

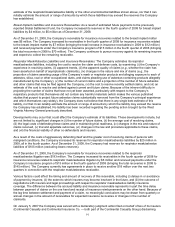

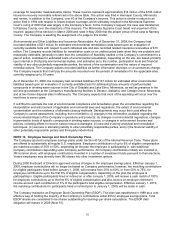

The following table provides information by level for assets and liabilities that are measured at fair value, as defined

by SFAS No. 157, on a recurring basis.

(Millions)

Fair Value

at

Dec. 31,

Fair Value Measurements

Using Inputs Considered as

Description 2008 Level 1 Level 2 Level 3

Assets:

Available-for-sale:

Marketable securities — except auction rate securities $ 724 $ 14 $ 710 $ —

Marketable securities — auction rate securities only .... 1 — — 1

Investments ................................................................... 5 5 — —

Derivative assets ............................................................... 279 221 58 —

Liabilities:

Derivative liabilities............................................................ 212 99 113 —