3M 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

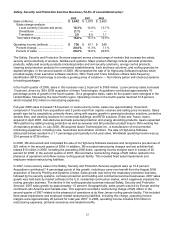

Systems. These eight reporting units all generated operating income for total year 2008. As part of its annual

impairment testing in the fourth quarter, 3M used discounted cash flow models for its CUNO, Optical Systems and

Security Systems divisions. A weighted-average discounted cash flow analysis was performed for the CUNO and

Optical Systems Divisions, using projected cash flows that were weighted based on different sales growth and

terminal value assumptions, among other factors. The weighting was based on managements’ estimates of the

likelihood of each scenario occurring. The discounted cash flows for the CUNO, Optical Systems and Security

Systems divisions were all in excess of their respective net book values, with no impairment indicated.

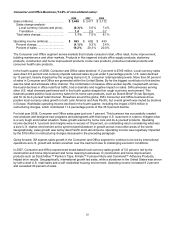

In 2008, in addition to using discounted cash flows for certain reporting units, 3M used an adjusted industry price-

earnings ratio approach for the remaining reporting units. 3M adjusted the stated applicable industry price-earnings

ratio downward for its annual test in the fourth quarter, unlike prior years when no adjustment was required. Without

this adjustment, the addition of each reporting unit’s estimated market values would have been significantly in excess

of 3M’s total Company market value, which would have resulted in an unusually high implied control premium. The

control premium is defined as the sum of the individual reporting units estimated market values compared to 3M’s

total Company market value, with the sum of the individual values typically being larger than the value for the total

Company. For example, at year-end 2008, 3M’s market value was approximately $40 billion, but if each reporting unit

was sold individually, 3M’s value would be approximately $52 billion using a 30 percent control premium. 3M factored

down its price/earnings ratio significantly for the respective reporting units to approximate what the price/earnings

ratio would be at a more normal historical control premium of approximately 30 percent for the total Company. Even

after including this adjustment to the price-earnings ratio, no goodwill impairment was indicated for any of the

reporting units. In addition, 3M’s market value at December 31, 2008 of approximately $40 billion is significantly in

excess of its book value of approximately $10 billion. 3M will continue to monitor its reporting units in 2009 for any

triggering events or other signs of impairment.

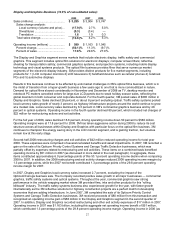

Income Taxes:

The extent of 3M’s operations involves dealing with uncertainties and judgments in the application of complex tax

regulations in a multitude of jurisdictions. The final taxes paid are dependent upon many factors, including

negotiations with taxing authorities in various jurisdictions and resolution of disputes arising from federal, state, and

international tax audits. The Company recognizes potential liabilities and records tax liabilities for anticipated tax

audit issues in the United States and other tax jurisdictions based on its estimate of whether, and the extent to which,

additional taxes will be due. As of January 1, 2007, the Company follows FIN 48 guidance to record these liabilities

(refer to Note 8 for additional information). The Company adjusts these reserves in light of changing facts and

circumstances; however, due to the complexity of some of these uncertainties, the ultimate resolution may result in a

payment that is materially different from the Company’s current estimate of the tax liabilities. If the Company’s

estimate of tax liabilities proves to be less than the ultimate assessment, an additional charge to expense would

result. If payment of these amounts ultimately proves to be less than the recorded amounts, the reversal of the

liabilities would result in tax benefits being recognized in the period when the Company determines the liabilities are

no longer necessary.

NEW ACCOUNTING PRONOUNCEMENTS

Information regarding new accounting pronouncements is included in Note 1 to the Consolidated Financial

Statements.

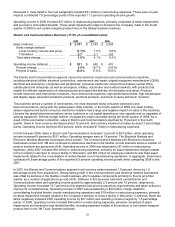

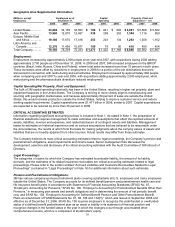

FINANCIAL CONDITION AND LIQUIDITY

The strength of 3M’s capital structure and consistency of its cash flows provide 3M stable access to capital markets

in these uncertain times. During recent dislocation in the financial markets, 3M has had uninterrupted access to the

commercial paper market. Interest rates on commercial paper issued by the Company have not been materially

negatively impacted by the market difficulties. 3M borrowed $850 million via a long-term debt issue in August 2008

with a coupon of 4.375%. 3M also raised $800 million via a three-year debt issue in October 2008 with a coupon of

4.5%. Despite the market turmoil, 3M was able to secure funding to alleviate concerns about having ample liquidity to

meet its foreseeable needs. As indicated in the table below, at December 31, 2008, 3M had $2.6 billion of cash, cash

equivalents, and marketable securities and $6.7 billion of debt. Debt is comprised of $1.552 billion of short-term debt,

including $575 million of commercial paper, and $5.166 billion of long-term debt. Approximately $900 million of the

long-term debt is classified as current, including $350 million in Dealer Remarketable Securities, which ultimately

mature in December 2010, and a $62 million floating rate note, which has a put option. At December 31, 2008, the

majority of the Company’s long-term debt balance does not mature until 2011 or later. Thus, while credit markets

remain volatile, 3M’s capital structure remains very strong. 3M is committed to managing its capital structure very

carefully.