3M 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.72

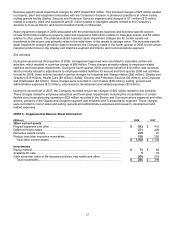

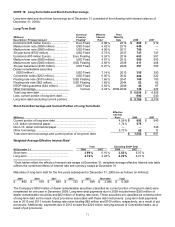

The ESOP debt is serviced by dividends on stock held by the ESOP and by Company contributions. These

contributions are not reported as interest expense, but are reported as an employee benefit expense in the

Consolidated Statement of Income. Other borrowings includes debt held by 3M’s international companies and

floating rate notes in the United States, with the long-term portion of this debt primarily composed of U.S. dollar

floating rate debt.

The Company has an AA credit rating, with a stable outlook, from Standard & Poor’s and an Aa1 credit rating, with a

negative outlook, from Moody’s Investors Service. At December 31, 2008, certain debt agreements ($350 million of

dealer remarketable securities and $44 million of ESOP debt) had ratings triggers (BBB-/Baa3 or lower) that would

require repayment of debt. In addition, under the Company’s $1.5-billion five-year credit facility agreement that was

effective April 30, 2007, 3M is required to maintain its EBITDA to Interest Ratio as of the end of each fiscal quarter at

not less than 3.0 to 1. This is calculated (as defined in the agreement) as the ratio of consolidated total EBITDA for

the four consecutive quarters then ended to total interest expense on all funded debt for the same period. At

December 31, 2008, this ratio was approximately 30 to 1. At December 31, 2008, available short-term committed

lines of credit, including the preceding $1.5 billion five-year credit facility, totaled approximately $1.582 billion, of

which approximately $143 million was utilized in connection with normal business activities. Debt covenants do not

restrict the payment of dividends.

The Company has a “well-known seasoned issuer” shelf registration statement, effective February 24, 2006, which

registers an indeterminate amount of debt or equity securities for future sales. On June 15, 2007, the Company

registered 150,718 shares of the Company’s common stock under this shelf on behalf of and for the sole benefit of

the selling stockholders in connection with the Company’s acquisition of assets of Diamond Productions, Inc. The

Company intends to use the proceeds from its future securities sales off this shelf for general corporate purposes. In

connection with this shelf registration, in June 2007 the Company filed a prospectus relating to the offering of up to

$3 billion of medium-term notes. In December 2007, 3M issued a five-year, $500 million, fixed rate note with a

coupon rate of 4.65% under this medium-term notes program. In August 2008, 3M issued a five-year, $850 million,

fixed rate note with a coupon rate of 4.375% under this medium-term notes program. In October 2008, the Company

issued a three-year $800 million, fixed rate note with a coupon rate of 4.50% under this medium-term notes program,

reducing remaining capacity to $850 million as of December 31, 2008. The Company has the ability to increase the

amount of securities that are authorized to be issued under this program.

The Company also issued notes under an earlier medium-term note program. In March 2007, the Company issued a

30-year, $750 million, fixed rate note with a coupon rate of 5.70%. In November 2006, 3M issued a three-year, $400

million, fixed rate note. The Company entered into an interest rate swap to convert this to a rate based on a floating

LIBOR index. In December 2004, 3M issued a 40-year, $62 million, floating rate note, with the rate based on a

floating LIBOR index. This $1.5 billion medium term notes program was replaced by the $3 billion program

established in June 2007.

In July 2007, 3M issued a seven year 5.0% fixed rate Eurobond for an amount of 750 million Euros (book value of

approximately $1.094 billion in U.S. Dollars at December 31, 2008). Upon debt issuance in July 2007, 3M completed

a fixed-to-floating interest rate swap on a notional amount of 400 million Euros as a fair value hedge of a portion of

the fixed interest rate Eurobond obligation. In December 2007, 3M reopened the existing seven year 5.0% fixed rate

Eurobond for an additional amount of 275 million Euros (book value of approximately $391 million in U.S. Dollars at

December 31, 2008). This security was issued at a premium and was subsequently consolidated with the original

security on January 15, 2008.

3M may redeem its 30-year zero-coupon senior notes (the “Convertible Notes”) at any time in whole or in part at the

accreted conversion price; however, bondholders may convert upon notification of redemption each of the notes into

9.4602 shares of 3M common stock. Holders of the 30-year zero-coupon senior notes have the option to require 3M

to purchase their notes at accreted value on November 21 in the years 2005, 2007, 2012, 2017, 2022 and 2027. In

November 2005, 22,506 of the 639,000 in outstanding bonds were redeemed, resulting in a payout from 3M of

approximately $20 million. In November 2007, an additional 364,598 outstanding bonds were redeemed resulting in a

payout from 3M of approximately $322 million. These payouts reduced the Convertible Notes’ face value at maturity

to $252 million, which equates to a book value of approximately $224 million at December 31, 2008. As disclosed in

a Form 8-K in November 2005, 3M amended the terms of these securities to pay cash at a rate of 2.40% per annum

of the principal amount at maturity of the Company’s Convertible Notes, which equates to 2.75% per annum of the

notes’ accreted value on November 21, 2005. The cash interest payments were made semiannually in arrears on

May 22, 2006, November 22, 2006, May 22, 2007 and November 22, 2007 to holders of record on the 15th calendar

day preceding each such interest payment date. Effective November 22, 2007, the effective interest rate reverted

back to the original yield of 0.50%.