3M 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.15

During 2008 the funded status of the Company’s global pension plans declined from 100 percent to 85 percent. As of

December 31, 2008, the U.S. pension plans’ funded status was 89 percent with the qualified plan at 92 percent, and

the international plans at 75 percent. By utilizing an effective hedging strategy for both fixed income and equity

investments, the Company was able to limit the decline in U.S. pension plan’s assets to a negative 13.6% return in

2008, much better than the overall market. In 2009, the Company expects to contribute an amount in the range of

$600 million to $850 million to its U.S. and international pension plans. The Company does not have a required

minimum pension contribution obligation for its U.S. plans in 2009. The changes in 3M’s defined benefit pension and

postretirement plans’ funded status, which are required to be measured as of each year-end, significantly impacted

several balance sheet line amounts at December 31, 2008. In the fourth quarter of 2008, these required annual

measurements decreased prepaid pension benefits’ assets by $1.7 billion, increased deferred taxes within other

assets by $1.1 billion, increased pension and postretirement benefits’ long-term liabilities by $1.7 billion and

decreased stockholders’ equity (reflected after taxes) by $2.3 billion. Other pension and postretirement changes

during the year, such as contributions and amortization, also impacted these balance sheet captions. Refer to critical

accounting estimates within MD&A and Note 11 (Pension and Postretirement Benefit Plans) for additional information

concerning 3M’s pension and post-retirement plans.

The preceding forward-looking statements involve risks and uncertainties that could cause results to differ materially

from those projected (refer to the forward-looking statements section in Item 7 and the risk factors provided in Item

1A for discussion of these risks and uncertainties).

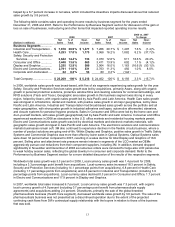

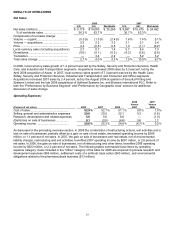

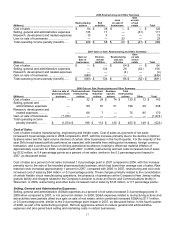

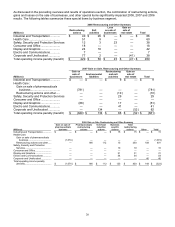

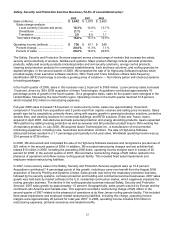

Special Items:

Special items represent significant charges or credits that are important to understanding changes in the Company’s

underlying operations.

In 2008, net losses for restructuring and other actions decreased operating income by $269 million and net income

by $194 million, or $0.28 per diluted share. 2008 included restructuring actions ($229 million pre-tax, $147 million

after-tax and minority interest), exit activities ($58 million pre-tax, $43 million after-tax) and losses related to the sale

of businesses ($23 million pre-tax, $32 million after-tax), which were partially offset by a gain on sale of real estate

($41 million pre-tax, $28 million after-tax). Divestiture impacts, restructuring actions and exit activities are discussed

in more detail in Note 2 (Acquisitions and Divestitures) and Note 4 (Restructuring Actions and Exit Activities).

Concerning the real estate gain, 3M received proceeds and recorded a gain in 2008 for a sale-leaseback transaction

relative to an administrative location in Italy. 3M anticipates leasing back the facility through late 2009 at which time a

new location will be utilized.

In 2007, gains on sale of businesses and real estate, net of restructuring and other items, increased operating

income by $681 million and net income by $448 million, or $0.62 per diluted share. 2007 included net benefits from

gains related to the sale of businesses ($849 million pre-tax, $550 million after-tax) and a gain on sale of real estate

($52 million pre-tax, $37 million after-tax), which were partially offset by increases in environmental liabilities ($134

million pre-tax, $83 million after-tax), restructuring actions ($41 million pre-tax, $27 million after-tax), and other exit

activities ($45 million pre-tax, $29 million after-tax). These items, except the gain on sale of real estate, are

discussed in more detail in Note 2 (Acquisitions and Divestitures), Note 4 (Restructuring Actions and Exit Activities)

and Note 14 (Commitments and Contingencies). Gains on sale of businesses include the second-quarter 2007 sale

of 3M’s Opticom Priority Control Systems and Canoga Traffic Detection businesses, and the first-quarter 2007 sale of

the global branded pharmaceuticals business in Europe. Concerning the real estate sale, 3M sold a laboratory facility

located in Suwon, Korea.

In 2006, gains on sale of businesses, net of restructuring and other items, increased operating income by $523

million and net income by $438 million, or $0.57 per diluted share. 2006 included net benefits from gains related to

the sale of certain portions of 3M’s branded pharmaceuticals business ($1.074 billion pre-tax, $674 million after-tax)

and favorable income tax adjustments ($149 million), which were partially offset by restructuring actions ($403 million

pre-tax, $257 million after-tax), acquired in-process research and development expenses ($95 million pre-tax and

after-tax), settlement costs of an antitrust class action ($40 million pre-tax, $25 million after-tax), and environmental

obligations related to the pharmaceuticals business ($13 million pre-tax, $8 million after-tax). These items, except the

settlement costs and environmental obligations, are discussed in more detail in Note 2 (Acquisitions and

Divestitures), Note 4 (Restructuring Actions and Exit Activities) and Note 8 (Income Taxes). Concerning settlement

costs, the Company recorded $40 million in 2006 with respect to a settlement in principle related to the antitrust class

action brought on behalf of direct purchasers who did not purchase private label tape. Concerning environmental

obligations, the Company increased its reserves by $13 million during 2006 for estimated environmental remediation

costs at a European pharmaceutical plant.