3M 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.56

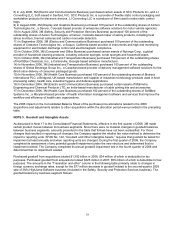

4) In May 2007, 3M (Safety, Security and Protection Services Business) purchased 100 percent of the outstanding

shares of E Wood Holdings PLC, a North Yorkshire, UK-based manufacturer of high performance protective coatings

for oil, gas, water, rail and automotive industries.

5) In May 2007, 3M (Electro and Communications Business) purchased certain assets of Innovative Paper

Technologies LLC, a manufacturer of inorganic-based technical papers, boards and laminates for a wide variety of

high temperature applications and Powell LLC, a supplier of non-woven polyester mats for the electrical industry.

6) In May 2007, 3M (Health Care Business) purchased certain assets of Articulos de Papel DMS Chile, a Santiago,

Chile-based manufacturer of disposable surgical packs, drapes, gowns and kits.

7) In June 2007, 3M (Industrial and Transportation Business) purchased certain assets of Diamond Productions Inc.,

a manufacturer of superabrasive diamond and cubic boron nitride wheels and tools for dimensioning and finishing

hard-to-grind materials in metalworking, woodworking and stone fabrication markets in exchange for approximately

150 thousand shares of 3M common stock, which had a market value of $13 million at the acquisition measurement

date and was previously held as 3M treasury stock.

8) In July 2007, 3M (Safety, Security and Protection Services Business) purchased 100 percent of the outstanding

shares of Rochford Thompson Equipment Ltd., a manufacturer of optical character recognition passport readers

used by airlines and immigration authorities, headquartered in Newbury, U.K.

9) In August 2007, 3M (Health Care Business) purchased certain assets of Neoplast Co. Ltd., a

manufacturer/distributor of surgical tapes and dressings and first aid bandages for both the professional and

consumer markets across the Asia Pacific region.

10) In October 2007, 3M (Health Care Business) purchased 100 percent of the outstanding shares of Abzil Industria

e Comercio Ltda., a manufacturer of orthodontic products based in Sao Jose do Rio Preto, Sao Paulo, Brazil.

11) In October 2007, 3M (Industrial and Transportation Business) purchased 100 percent of the outstanding shares

of Venture Tape Corp. and certain related entities, a global provider of pressure sensitive adhesive tapes based in

Rockland, Mass.

12) In October 2007, 3M (Display and Graphics Business) purchased certain assets of Macroworx Media Pvt Ltd., a

software company that specializes in the design and development of digital signage solutions based in Bangalore,

India.

13) In October 2007, 3M (Health Care Business) purchased 100 percent of the outstanding shares of Lingualcare

Inc., a Dallas-based orthodontic technology and services company offering the iBraces system, a customized, lingual

orthodontic solution.

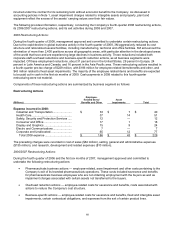

14) In November 2007, 3M (Industrial and Transportation Business) purchased certain assets of Standard Abrasives,

a manufacturer of coated abrasive specialties and non-woven abrasive products for the metalworking industry

headquartered in Simi Valley, Ca.

15) In November 2007, 3M (Industrial and Transportation Business) purchased 100 percent of the outstanding

shares of Unifam Sp. z o.o., a manufacturer of cut-off wheels, depressed center grinding wheels and flap discs based

in Poland.

16) In November 2007, 3M (Industrial and Transportation Business) purchased certain assets of Bondo Corp., a

manufacturer of auto body repair products for the automotive aftermarket and various other professional and

consumer applications based in Atlanta, Ga.

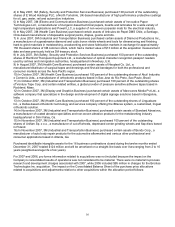

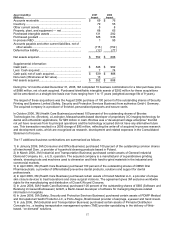

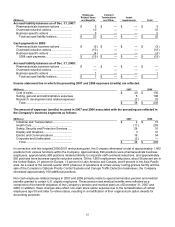

Purchased identifiable intangible assets for the 16 business combinations closed during the twelve months ended

December 31, 2007 totaled $124 million and will be amortized on a straight-line basis over lives ranging from 2 to 10

years (weighted-average life of six years).

For 2007 and 2006, pro forma information related to acquisitions was not included because the impact on the

Company’s consolidated results of operations was not considered to be material. There were no material in-process

research and development charges associated with 2007, while 2006 included $95 million in charges for the Brontes

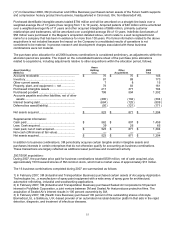

Technologies Inc. acquisition. The impact on the Consolidated Balance Sheet of the purchase price allocations

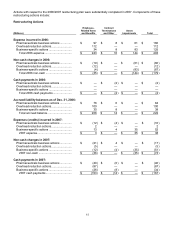

related to acquisitions and adjustments relative to other acquisitions within the allocation period follows: