3M 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

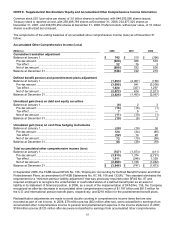

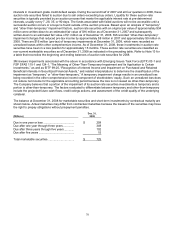

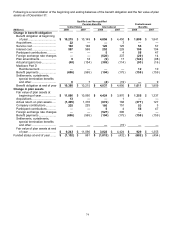

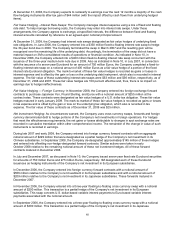

Qualified and Non-qualified

Pension Benefits Postretirement

United States International Benefits

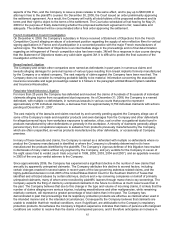

(Millions) 2008 2007 2008 2007 2008 2007

Amounts recognized in the

Consolidated Balance Sheet

as of Dec. 31,

Non-current assets .............. $ — $ 1,246 $36

$ 132

$ — $—

Accrued benefit cost ............

Current liabilities............... (31 ) (27 ) (5 ) (6 ) (2 ) (2 )

Non-current liabilities ....... (1,121 ) (338 ) (1,046 ) (558 ) (680 ) (452 )

Ending balance.................... $ (1,152 ) $ 881 $ (1,015 ) $ (432 ) $ (682 ) $ (454 )

Amounts recognized in

accumulated other

comprehensive income as of

Dec. 31,

Net transition obligation (asset) $ — $ — $(3) $1

$ — $—

Net actuarial loss (gain)....... 3,489 1,210 1,468 884

1,089 768

Prior service cost (credit)..... 62 68 (80 ) (45 ) (416 ) (365 )

Ending balance.................... $ 3,551 $ 1,278 $ 1,385 $ 840

$ 673 $ 403

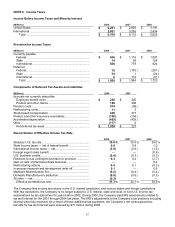

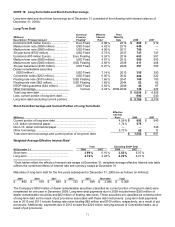

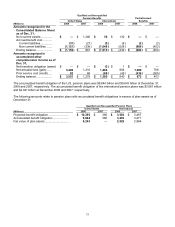

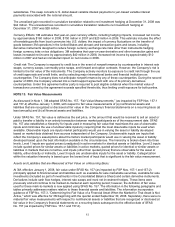

The accumulated benefit obligation of the U.S. pension plans was $9.844 billion and $9.643 billion at December 31,

2008 and 2007, respectively. The accumulated benefit obligation of the international pension plans was $3.681 billion

and $4.421 billion at December 2008 and 2007, respectively.

The following amounts relate to pension plans with accumulated benefit obligations in excess of plan assets as of

December 31:

Qualified and Non-qualified Pension Plans

United States International

(Millions) 2008 2007 2008 2007

Projected benefit obligation.......................... $ 10,395 $ 360 $ 3,562

$ 3,497

Accumulated benefit obligation .................... 9,844 360 3,293

3,271

Fair value of plan assets .............................. 9,243 —

2,529

2,984