3M 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

asset diminishes in value. For 3M, EITF 08-6 is effective for transactions occurring after December 31, 2008. The

Company considers this standard in terms of evaluating potential future transactions to which it would apply.

In December 2008, the FASB issued FSP No. FAS 132(R)-1, “Employers’ Disclosures about Postretirement Benefit

Plan Assets”. This FSP requires additional disclosures about plan assets for sponsors of defined benefit pension and

postretirement plans including expanded information regarding investment strategies, major categories of plan

assets, and concentrations of risk within plan assets. Additionally, this FSP requires disclosures similar to those

required under SFAS No. 157 with respect to the fair value of plan assets such as the inputs and valuation

techniques used to measure fair value and information with respect to classification of plan assets in terms of the

hierarchy of the source of information used to determine their value (see Note 13). The disclosures under this FSP

are required for annual periods ending after December 15, 2009. 3M is currently evaluating the requirements of these

additional disclosures.

In January 2009, the FASB issued FSP No. EITF 99-20-1, “Amendments to the Impairment Guidance of EITF Issue

No. 99-20” (FSP No. EITF 99-20-1). This FSP provided additional guidance with respect to how entities determine

whether an “other-than-temporary impairment” (OTTI) exists for certain beneficial interests in a securitized

transaction, such as asset-backed securities and mortgage-backed securities, that (1) do not have a high quality

rating or (2) can be contractually prepaid or otherwise settled such that the holder would not recover substantially all

of its investment. FSP No. EITF 99-20-1 amended EITF Issue No. 99-20 to more closely align its OTTI guidance with

that of SFAS No. 115, “Accounting for Certain Investment in Debt and Equity Securities.” This FSP was effective for

3M prospectively beginning October 1, 2008. The Company considered this FSP’s additional interpretation of EITF

Issue No. 99-20 when classifying respective additional impairments as “temporary” or “other-than-temporary”

beginning with the fourth quarter of 2008. This FSP had no material impact on such classifications.

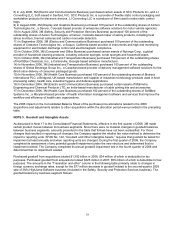

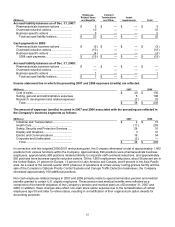

NOTE 2. Acquisitions and Divestitures

Divestitures:

In June 2008, 3M completed the sale of HighJump Software, a 3M Company, to Battery Ventures, a technology

venture capital and private equity firm. 3M received proceeds of $85 million for this transaction and recognized, net of

assets sold, transaction and other costs, a pre-tax loss of $23 million (recorded in the Safety, Security and Protection

Services segment) in 2008.

In June 2007, 3M completed the sale of its Opticom Priority Control Systems and Canoga Traffic Detection

businesses to TorQuest Partners Inc., a Toronto-based investment firm. 3M received proceeds of $80 million for this

transaction and recognized, net of assets sold, transaction and other costs, a pre-tax gain of $68 million (recorded in

the Display and Graphics segment) in 2007.

In January 2007, 3M completed the sale of its global branded pharmaceuticals business in Europe to Meda AB. 3M

received proceeds of $817 million for this transaction and recognized, net of assets sold, a pre-tax gain of $781

million (recorded in the Health Care segment) in 2007.

In December 2006, 3M completed the sale of its global branded pharmaceuticals business in the United States,

Canada, and Latin America region and the Asia Pacific region, including Australia and South Africa. 3M received

proceeds of $1.209 billion for this transaction and recognized, net of assets sold, a pre-tax gain of $1.074 billion

(recorded in Health Care Business) in 2006.

Buyer and sale price information by region is as follows:

• Meda AB acquired 3M’s pharmaceuticals business in Europe for $817 million in 2007.

• Graceway Pharmaceuticals Inc. acquired 3M’s pharmaceutical operations in the United States, Canada, and

Latin America for $860 million in 2006.

• Ironbridge Capital and Archer Capital acquired 3M’s pharmaceuticals business in the Asia Pacific region,

including Australia and South Africa for $349 million in 2006.

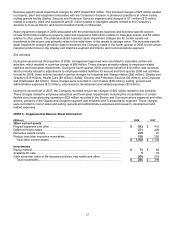

The agreements are the result of a review of strategic options for the branded pharmaceuticals business and its

immune response modifier (IRM) platform that 3M announced in April 2006. Under the agreements, the purchasers

acquired regional marketing and intellectual property rights for 3M’s well-known branded pharmaceuticals, including

Aldara, Difflam, Duromine, Tambocor, Maxair, Metrogel-Vaginal and Minitran. As part of the transaction, Graceway

Pharmaceuticals also acquired the rights to certain IRM molecules.

In connection with these transactions, 3M entered into agreements whereby its Drug Delivery Systems Division

became a source of supply to the acquiring companies. Because of the extent of 3M cash flows from these

agreements in relation to those of the disposed-of businesses, the operations of the branded pharmaceuticals